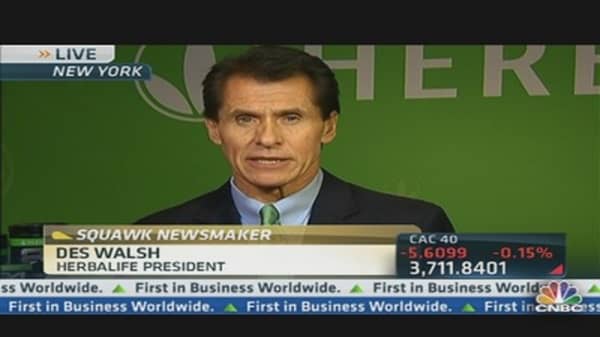

"The majority of our distributors become distributors because of their affinity with the product, and they want to receive a product discount," explained Walsh, saying they effectively want to become almost "club members just like in Costco."

"Of those distributors who come for the business opportunity absolutely they make money. ... Our core training for a distributor who wants to build a business is they talk to 10 customers a day — 10 people a day — about the products, the business opportunity." Walsh also claimed that he has not talked to any distributors who are following that model and not making money.

Herbalife hired well-known attorney David Boies, chairman of Boies, Schiller & Flexner, a week before Christmas to look into what he calls a "rash of inaccurate statements" made about the company. Boies told CNBC in an interview Thursday that Herbalife may have a case against Ackman, who delivered a presentation on his claims Dec. 20.

"Pershing Square is going to have to decide why it's making those kind of statements," Boies said. "If we were ever to litigate it, maybe we'd get some discovery about it."

Taking the other side of that trade, rival hedge fund manager Dan Loeb stepped into the fray on Wednesday, when a regulatory filing showed that Loeb's Third Point has taken an 8 percent stake in Herbalife.

Loeb called Ackman's short thesis "preposterous," taking a long position worth about $350 million.

(Read More:

Why Loeb Is Long Herbalife

)

Meanwhile, activist investor Carl Icahn is said to be lining up on Loeb's side. The New York Post quoted sources who say Icahn has also taken a long position in Herbalife.