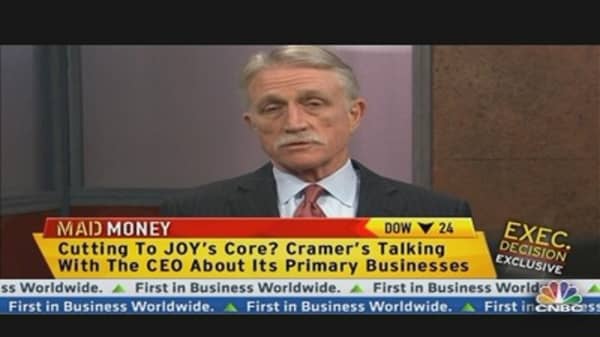

If comments made by Sutherlin on Mad Money's Wednesday January 16th broadcast are any indication – it should accelerate nicely.

"We track a lot of things that can be discreetly measured that are highly correlated to economic performance," said Sutherlin.

Looking at electricity demand again, "In

China

that has continued to improve. In November it was up almost 8% year over year. Also, we're seeing steel production improve. In addition, truck haul volumes are up. All told, we're seeing real significant improvement in a lot of different indicators that we look at - indicators that are correlated to economic and industrial growth."

And Sutherlin sees another potentially bullish catalyst for

China

.

"In addition – one of the real underlying stories is the re-stocking phase," he said. "China had really reduced stock levels significantly. For example, independent power producers reduced inventories of coal from 31 days down to 18 days. Steel mills had reduced inventories of coal from 18 days to 12 days. All of these stock levels will have to be replenished."

That's on top of the improvement in demand suggested by the increase in electricity usage.

All that would seem bullish for the demand for commodities – and by proxy Joy Global.

"The early signs are (positive), said Sutherlin, but in the second half of 2013 is when I think we'll see an improved China translate into improved order rates for our business."

Currently, Joy Global is projecting fiscal 2013 earnings per share between $5.90 and $6.50 on revenue of $4.9 billion to $5.2 billion.

As strong as those numbers are, Cramer thinks the estimates for 2013 could be too low.

"With China coming back, I think Joy Global is too cheap. It's true Joy Global was among the worst performers in the S&P 500 last year,' said Cramer, "but in 2013 I think it could be among the best!"