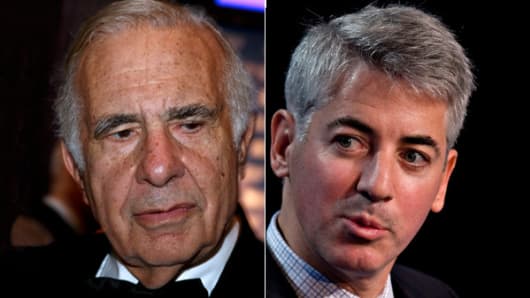

Getty Images | CNBC composite

Carl Icahn (L), Bill Ackman (R)

Bear case (Ackman): Skeptics are betting the stock goes lower - a lot lower. However, "to get the stock to zero Ackman needs the government to intervene on his side and prosecute Herbalife to wipe it out," said Cramer. "Without the government 's help, meaning a Justice Department or state attorney general, this company probably won't go to zero on its own volition. It makes too much money and people keep signing up to be distributors to sell the product." That's not to say it can't go down, it can.

Bull case (presumably Icahn): Buyers see catalysts for gains. "The company could take the money it makes and buy back its own stock," said Cramer. The company could also generate better and better profit reports, putting to rest market fears about the business model. Also, a short squeeze could drive shares higher – as those who borrowed stock and then sold it into the market are required to buy it back and return it.

Both strategies are compelling – and Cramer said either could play out. But he said the most important takeaway for retail investors is -- put money to work someplace else.

"I don't want to get between these two men and you shouldn't either," he said. "Herbalife's too hard to trade or own now because it is all about these egos making it a battleground stock. And if there's one thing Cramer avoids like the plague, it's a battleground stock.

Read More: Cramer's Take on Herbalife