Banks, retailers and many others may have suffered during Europe's downturn but one sector has remained rock solid during a time of weak consumer spending - tobacco.

Safer to own than to consume, cigarette stocks have earned enormous returns for investors in recent years as the euro zone crisis has raged.

British American Tobacco's shares have risen 42 percent, while shares of Imperial Tobacco have risen 33 percent over the past two years, compared to gains of 7.5 percent for the FTSE 100 index. Those gains exclude dividends, with the current yield on the two stocks at 4 percent and 4.5 percent respectively.

Analysts say the stocks are still attractive, even as the industry has more hurdles to overcome in the long term.

(Read More: Tobacco Stocks as Solid as Bonds: Strategist)

"Smokers have largely stuck to their habit in Europe through the downturn but have changed where they get their tobacco from. There has been an accelerated shift to lower price brands, rolling tobacco and illicit trade," James Bushnell, a tobacco analyst at Exane BNP Paribas told CNBC.com.

"The industry has so far shown remarkable resilience and earnings risk remains relatively low in the short-to-medium term."

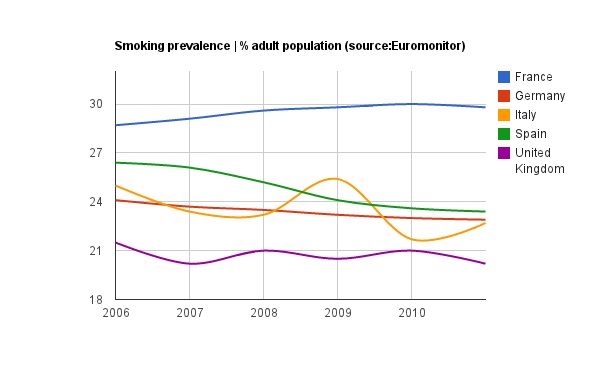

According to Euromonitor statistics, the percentage of the adult population that smoke has barely flickered for Western Europe, dipping from an average of 24 percent in 2006 to 22 percent in 2011. But the same statistics can't hide a more longer term decline in volumes, with companies plugging that gap by raising prices. In the U.K., twenty cigarettes from a top brand now cost around 13 dollars.

"Pricing is the only realistic growth driver in an industry whose volumes are under constant threat," Oriel Securities said in a research note.

"What investors should not lose sight of is that governments' objectives and what drives industry growth remain aligned. The most effective way to reduce smoking incidence in mature markets is for retail prices to rise."

(Read More: Want to Quit Smoking? Big Tobacco Is Ready)

Erik Bloomquist, senior analyst for consumer staples at Berenberg Bank, agrees. He highlights that while volumes for mature market economies in Europe are down 6 to 7 percent, profits are flattish.

Tobacco stocks remain a safety play in Europe, according to Bloomquist, with a robust cash flow outlook and dividend yields for 2013 of over 4 percent.

"The stocks we think have the most upside are Japan Tobacco, Philip Morris International and BAT [British American Tobacco]," he told CNBC.com.

"For pure plays on [emerging markets], stocks we think are interesting (but not under formal coverage) include Souza Cruz (Brazil), ITC (India) and Gudang Garam (Indonesia)."

(Read More: US Tobacco Companies, 17 States Settle Over Payments)

On Wednesday, Imperial Tobacco released a trading statement highlighting an increase in net revenues of 2 percent even as cigarette volumes declined 1 percent. Shares sunk over 3 percent by the close of the trading session.

"Our EU performance was impacted by further declines in legal market size with rising illicit trade, in what remains a competitive and tough economic environment," Imperial Tobacco said in its report, underlining a current talking point in the industry.

The Framework Convention on Tobacco Control from the World Health Organization aims to curb tobacco consumption. The latest part of the treaty, signed in early January, has targeted illicit trade.

Illicit trade is where cigarettes and tobacco have been smuggled over foreign borders, bootlegged from counties with lower taxes, or products that have been counterfeited.

"The protocol to eliminate illicit trade is a potential positive for the industry, illicit trade being one aspect where everyone loses (governments, public health, tobacco industry)," Bushnell said.

—By CNBC.com's Matt Clinch