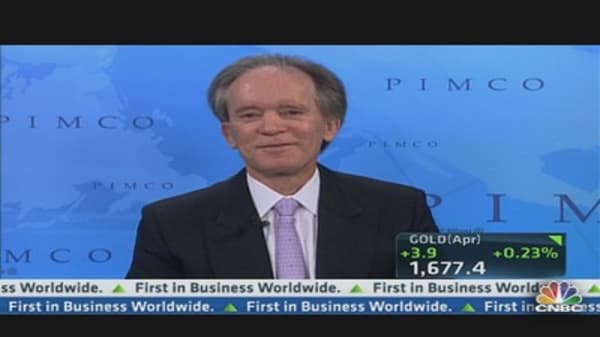

The money pouring into the stock market, as the Dow Jones Industrial Average and the S&P 500 Index rally to five-year highs, does not seem to be occurring at the expense of fixed-income investments, bond dealer Bill Gross told CNBC's "Squawk Box" on Wednesday.

Gross, founder of Pimco, which also has stock funds, said he thinks the stock inflows are coming from money market funds, capital gains and delayed dividend payments from last year "but not from the bond market at the moment."

He added that he's bullish on equities. "We think the market can go up 5 or 6 percent, and we know it's done that already in the month of January."