Cramer seems to agree.

"I think this is one of the best managed hotel names in the travel and leisure sector," he said.

By the numbers, Starwood forecast first-quarter earnings of 51 cents to 54 cents per share, topping analysts' expectations of 48 cents per share, according to Thomson Reuters I/B/E/S.

------------------------------------------------------------------

Read More from Cramer:

Buy & Hold This One?

Cramer: Have Faith in This CEO

Don't Get Spooked by This Revenue Miss

------------------------------------------------------------------

For the fourth quarter ended Dec. 31, net income from continuing operations fell to $65 million, or 33 cents per share, from $158 million, or 80 cents per share, a year earlier.

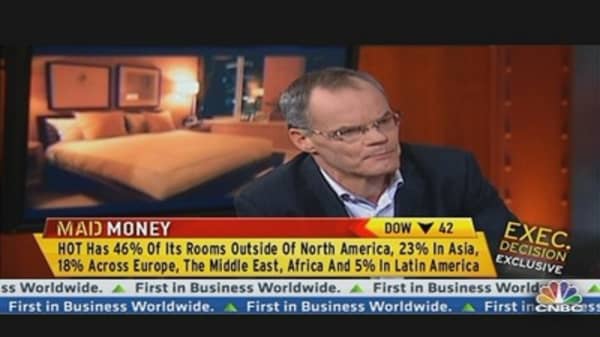

"Of the companies that have disparity between what they're worth and what they're selling for, this may be the largest," Cramer added. "They ticker symbol may be HOT but I think the stock is hotter."