U.S. single-family home prices picked up in December, closing out 2012 with the biggest yearly gain in more than six years as the housing market got back on its feet, a closely watched survey showed on Tuesday.

The S&P/Case Shiller composite index of 20 metropolitan areas rose 0.9 percent in December on a seasonally adjusted basis, topping expectations for a gain of 0.5 percent.

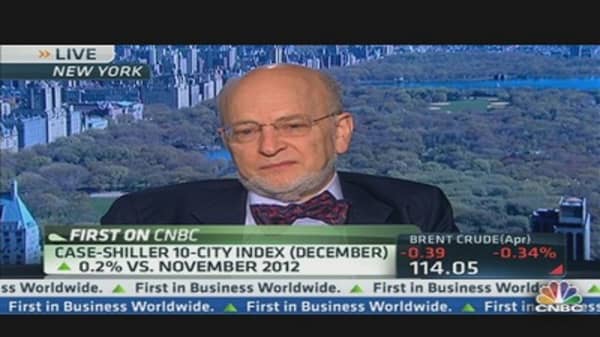

On a non-adjusted basis, prices were up 0.2 percent.

"The overall picture is very, very strong. All across the country things look good and only one city out of 20 was down on a year-to-year basis," said David Blitzer, Chairman of the S&P 500 Index Committee on CNBC's "Squawk on the Street." "If you look at a year-over-year basis, we are continuing to see gains and build momemtum. The rest of the housing numbers all reflect the fact that the entire housing spectrum has turned around."