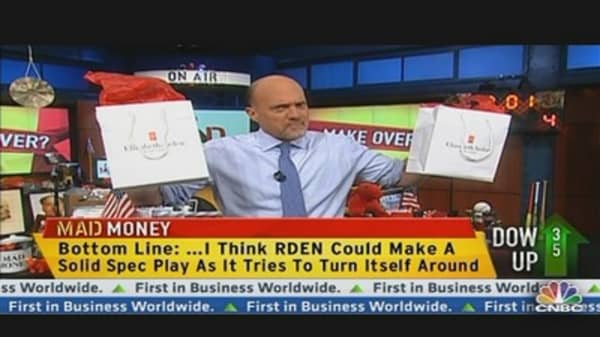

After making some rather harsh comments about this company in the past, Jim Cramer said "I am now convinced that this is a genuine turnaround play, albeit a speculative one."

The Mad Money host was talking about Elizabeth Arden (TICKER: RDEN), a maker of cosmetics and fragrances.

Earlier this month Cramer said some critical things about the company on Squawk on the Street. "Namely I said that it was wrong to mention the best of breed Este Lauder and Elizabeth Arden in the same sentence," Cramer admitted.

Largely Cramer was responding to the recent weakness in the stock that was triggered by weaker than expected earnings that showed holiday sales were soft, at best.

"Our net sales results were below original guidance due to lower than forecasted sales in department stores as well as softer than anticipated holiday sales at one of our major mass retail accounts," Chairman, President and CEO E. Scott Beattie said in a statement.

And the company lowered its full-year earnings forecast to between $2.30 and $2.50 per share from between $2.55 and $2.70 per share. Analysts were looking $2.66 on average, according to Thomson Reuters I/B/E/S.

"I figured after that quarter, what more did you need to know to stay away from this stock?" Cramer said.