They make less money but live longer—two trends that make saving for retirement more daunting for the female half of the U.S. population.

To cater to this group, a number of personal finance sites that focus on women have cropped up to help them wade through the intricacies of financial planning.

"Women weren't necessarily raised to think about money," said Amanda Steinberg, chief executive of DailyWorth.com. "The message from the media and Disney has always been: be a good wife, be a good mom, and money is up to the man."

Steinberg launched her company in January 2009 and has raised about $3 million to date, from investors such as Google Chairman Eric Schmidt's TomorrowVentures, DFJ Gotham and Gabriel Investments.

"I was really good at making money and really good at spending it," she said. "When I turned 30, I was really frustrated with the amount of money I was making and the fact that I didn't have any."

(Read More: Choice for Tight Times: Save More or More Risk)

Since those early days, the site's reach has ballooned to about 400,000 subscribers to its daily newsletters. At DailyWorth, the average user has a household income of about $100,000, is between 35 and 50 years old and college educated, Steinberg said.

Recently, the company redesigned its site, hired its first resident financial adviser and launched Money Clarity, a four-week $99 program that hopes to answer the "What's the next step?" question that women have after they become more interested in taking control of their financial futures.

"Traditionally men have responded to personal finance from a performance standpoint," Steinberg said. "Women are more interested in how does my life look like and how do I approach personal finance in the context of what's important to me in my life."

Because of this difference, the site aims to strike more of a conversational tone by emphasizing first-person stories and personal connections with headlines such as "How My Boyfriend's Trust Fund Almost Broke Us Up" and "Is Paying Kids for Good Grades a Bribe?"

(Read More: Nature or Nurture? Why Women Don't Save for Retirement)

Eyeing an opportunity to create loyal customers and retain current ones, both Wells Fargo and Citibank have also gotten into the space.

About 70 percent of widows leave their financial adviser within a year after their partner dies, Financial Advisor Magazine reported. This exodus means a sizable loss of assets for financial professionals, especially since women frequently outlive their spouses, according to a Pershing report titled "Women are not a 'niche' market. They are a significant business opportunity."

Interestingly, Wells Fargo's "ages and stages" section on its "Beyond Today" blog for retirement planning lacks a section for "in your 20s," a decade during which many advisers suggest people begin investing.

Alluding to the increasing financial power of women, one article on Citigroup's women & co. blog asks the increasing number of women "alpha wives" or female primary breadwinners, "do you love it, like it or resent it?" Interspersed within the free content are several ads hawking the bank's products, including credit cards, online bill pay and mortgage refinancing.

(Read More: Exit Plan - How to Retire Abroad: Ecuador)

The move by these banks to capture these women makes sense. According to a 2010 study from Prudential, 95 percent of women are involved in the financial decision making in their households and one fourth are the primary decision makers.

Women are also more likely than men to hire a financial adviser (46 percent compared to 34 percent), according to a 2011 survey from the Spectrum Group.

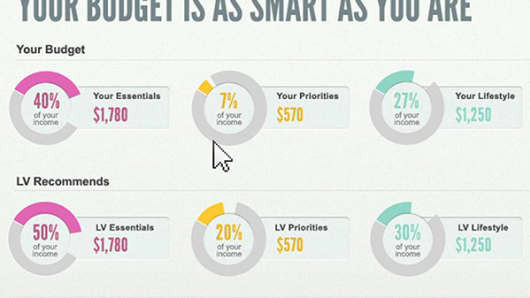

With the mission that financial planning shouldn't be a luxury, LearnVest seeks to reach this market by offering low-cost financial plans, beginning as low as a one-time fee of $69 plus a monthly charge of $19 for a budget assessment.

In December 2008, Founder and CEO Alexa von Tobel took a leave of absence from Harvard Business School with the goal of creating an easy-to-understand online personal finance resource for women.

"I just realized that so many people have questions about money — I had questions about money," von Tobel told CNBC's "Squawk on the Street."

"We don't learn about it in high schools or colleges across the country," she added. "And where do you go? If you don't have millions of dollars, literally who do you ask all of your money questions to make sure you're getting trusted unbiased advice? And I wanted to build that business."

(Read More: Seven Must-Haves for Your Dream Retirement Home)

Von Tobel isn't the only one interested in the concept. She has raised about $25 million in venture capital to date, led by Accel Partners.

What started out as a content-only website has morphed into one that can advise clients directly what to do with their money following its registration with the U.S. Securities and Exchange Commission. While advisers do not recommend specific stocks, they do help clients create budgets and retirement contribution plans.

"We now can give 360 degrees of advice — everything from insurance to estate planning to buying homes, buying cars, getting married," von Tobel said.