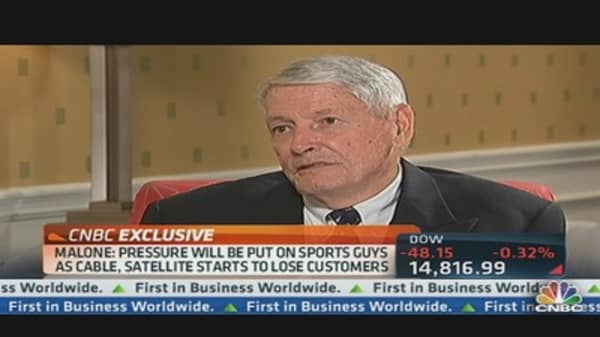

Markets are forcing change for cable operators, and the big players have a unique opportunity to work together, billionaire media titan John Malone told CNBC.

In a wide-ranging interview with CNBC's David Faber, Liberty Media's chairman said the industry will focus on international expansion and domestic broadband services. Although potential for collaboration exists with Internet-based, over-the-top content providers like Netflix or Hulu, he said, bundling of cable networks could begin to unravel within five years.

"I think it's at a point in history when the most addictive thing in the communications world is high-speed connectivity," he said. "Everywhere in the world that we operate, we've just seen the public want more and more data rate. Whether it's wireless or wired. There's a big appetite for it. Cable technology right now is the most cost-effective way to deliver that growth in speed."

(Related: Future of Broadcast TV an 'Open Queston': Liberty Media CEO)

Malone said that as more alternatives become available and broadband connectivity grows, over-the-top systems, which bypass cable operators for control and distribution, may begin to offer sports content and challenge the established system.