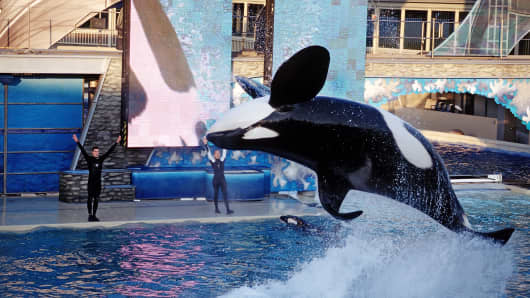

SeaWorld

It's likely you're already familiar with SeaWorld, a theme park operator. The company has eleven locations, including three Sea World locations, two Busch Garden locations, three Aquatica locations, as well as Sesame Place, Discovery Cover, and Adventure Island.

"I've liked the theme park plays for some time," said Jim Cramer. "That includes stocks such as Six Flags and Cedar Fair, and I think SeaWorld gives you a new, faster-growing way to play this very strong business."

That is, "SeaWorld has the fastest revenue growth in the space, a 7.2% increase last year, and they have the highest per capita spending at their parks," Cramer said.

Looking at the IPO, SeaWorld plans to sell 20 million shares at a price range of $24 to $27, and at the mid-point of that range, this would be a $2.4 billion company.

At those levels, SeaWorld would be trading with roughly the same valuation as rival Cedar Fair, and it would be selling for about a 13% discount to rival Six Flags.

"I can endorse getting a piece of the SeaWorld deal as long as it doesn't go out above the high-end of the range at $27," Cramer concluded.