Intel

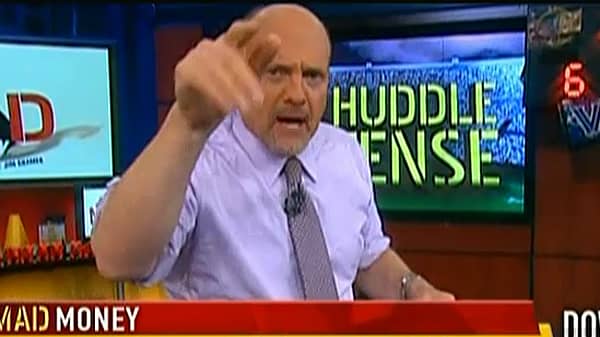

"Oh boy, Intel, has a real dead horse problem," Cramer said. "The company is spending a fortune on capital goods and they are not getting the bang for the buck that they used to. So the dead horse here is whether Intel is spending too much on its future without a payoff."

Intel said its capital spending in 2013 would be $13 billion, plus or minus $500 million, exceeding what many analysts had expected.

"It was a harsh part of the dialogue," said Cramer and may have distracted the Street from positives; for example, earnings beat estimates and revenues met forecasts.

---------------------------------------------------------------------

Read More from Mad Money with Jim Cramer

Cramer: Gold Bulls to Laugh Last

IPO to Make a Splash

Cramer Sorts Out Bank Stocks

---------------------------------------------------------------------

"When you get under the numbers and look at the driver, for us 2012 was a year where we refreshed our product line across every major business," said Intel CFO Stacy Smith. "We're seeing just a ton of innovation. That is what allowed us to come in as expected and set the guidance we did for 2013."

For the first quarter, the company sees revenue of $12.2 to $13.2 billion.

Unfortunately in the case of Intel as in the case of Yahoo! the horses and elephants trampled the price action.

Shares slipped 2% over 5 days. (Read More: Intel Tops Forecasts)

"Hence, despite beating Wall Street's expectations in a big way, their stocks did not react as a shareholder would hope if not expet." That is neither stock has been rewarded for the company's relative strength.

For Yahoo and Intel the dead horse got the better of them," said Cramer. "At least for now. "