The Mad Money host thinks when buyers return, it's the companies that can 'do no wrong' that will attract money.

Those are:

1. Companies that benefit from declining commodity prices.

2. Companies that can raises prices in a weak economy.

Looking at who benefits from lower commodities, Cramer said, "That's pretty much everything that sells at a supermarket or a drug store."

As an example, Cramer cited Head and Shoulders shampoo which is made by Procter & Gamble. "That plastic bottle - it costs less because of the low price of natural gas. The shampoo inside the bottle is also cheaper for the same reason."

Or think Corn Flakes made by Kellogg. "Corn is cheaper," he said, "And the wrapping is also cheaper because its plastic."

Cramer said Coca-Cola could be in a similar situation. "The cost of making aluminum cans is down; same with corn syrup used to make the soda sweet. Even the fuel in the Coke trucks is lower."

And the thesis extends beyond consumer staples.

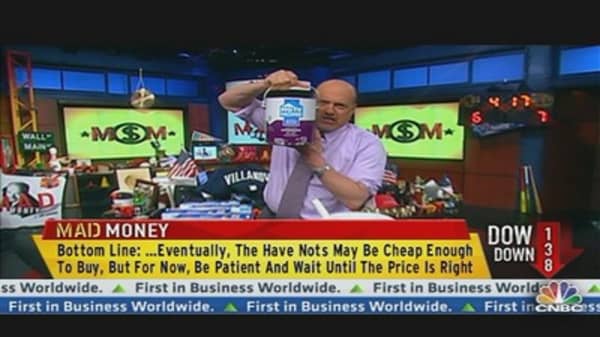

"Look at Whirlpool," said Cramer. "The cost of the steel and energy needed to make a washer and dryer is coming down." Or he said to take a look at Sherwin Williams. "That's all petroleum based and it's coming down across the board."

Citing companies that could raise prices in a weak economy Cramer said, "Celgene could easily raise the price of Revlimid, its breakthrough cancer drug. Same with Eylea, a drug from Regeneron that can help people with macular degeneration see again.

---------------------------------------------------------------------

Read More from Mad Money with Jim Cramer

Cramer: Gold Bulls to Laugh Last

IPO to Make a Splash

Cramer Sorts Out Bank Stocks

---------------------------------------------------------------------