SeaWorld said in its filing it hopes to continue growing business "by continually introducing new attractions," and it has started experimenting with "dynamic pricing," where prices move up or down depending on demand. Last year, the average customer spent nearly 4 percent more on admission and concessions, totaling $58.37.

"It's expensive for a family of four, but it's a good experience," said Steve Churchill outside the park entrance. "You can't see that stuff in Kansas."

Andrea Porras with was her son Jah Amaru. "As a kid I learned (about) and loved Shamu so much, and so I can't wait for my son to have that in his life as well," she said.

"San Diego stands as one of the top 10 tourist destinations (in the U.S.) for international travelers, and SeaWorld is one of the major attractions for those travelers," said Tony Cherin, professor emeritus of finance at San Diego State University. "Representative of that fact was when (California) Gov. Brown most recently went to China, part of his entourage was the marketing vice president of SeaWorld."

(Read More: Cramer: IPO to Make a Splash)

Even after the IPO, Blackstone will still own more than 60 percent of the company. If shares price in the mid-point of the expected range, SeaWorld will have a price-to-trailing-earnings ratio higher than peers.

In its filing the company also lists risks to the business. "We are high leveraged," with nearly $1.7 billion in debt. That could "hurt our ability to raise additional capital" and "limit our ability to react to changes in the economy or our industry," the filing said.

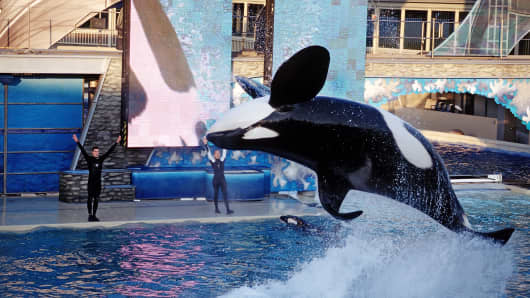

SeaWorld Entertainment, which boasts 67,000 animals, also faces unique risks because of its animals. The company said it could be adversely impacted by "changes in or violations of federal and state regulations governing the treatment of animals," and "featuring animals at our theme parks involves some degree of risk to our employees and guests which could materially adversely affect us." The company is appealing federal safety violations over the death in 2010 of a trainer in Florida attacked by one of its killer whales.

(Read More: Hot IPO Market Falters. Why?)

Finally, IBISWorld said the U.S. theme park industry generated about $11 billion in 2011 and attracted 315 million visitors. Goldman Sachs (which just happens to be a lead underwriter of the IPO) recently wrote, "Amusement parks are a standout when compared to our hospitality coverage ... a mature industry that 'gets it.' "

We'll know if the market agrees once shares start trading Friday morning—will they make a splash, or end up under water?

—By CNBC's Jane Wells; Follow her on Twitter: @janewells