(Having trouble with the video? Click here!)

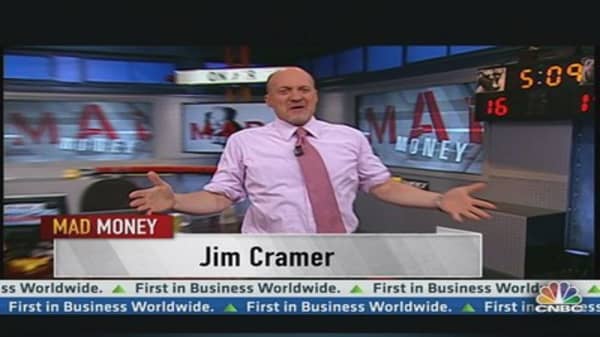

For the first time in a while, Cramer has spotted a significant caution sign in the stock market.

"I think Thursday was the first truly speculative day in a while," Cramer said. "I'm seeing a first glimpse of froth." That is, the Mad Money host has identified a development that suggests to him that the market may be getting ahead of itself.

Specifically, Cramer doesn't like the biggest gainers in Thursday's session. In a healthy bull advance, companies that benefit from an uptick in global growth should be among the biggest gainers. Typically that's companies in sectors such as the industrials or materials or technology.

However, on Thursday Tesla, Green Mountain Coffee Roasters and Barnes & Noble were among the day's best performers. And performed they did. By the end of Thursday's session Tesla gained 24%, Green Mountain gained 27% while Barnes and Noble gained 24%.

That gives pros like Cramer cause for concern because all 3 of these stocks have issues.