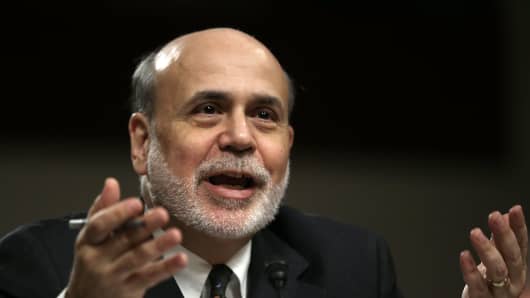

Searching for Nuance, Bernanke Does Figure Eights'

"If we see continued improvement and we have confidence that that's going to be sustained then we could in the next few meetings … take a step down in our pace of purchases," said Bernanke. "If we do that it would not mean that we are automatically aiming towards a complete wind down. Rather we would be looking beyond that to see how the economy evolves and we could either raise or lower our pace of purchases going forward."

Stocks resumed their upward climb while Bernanke spoke, but gave up gains in the 1 p.m. ET hour and continued to sell off after the 2 p.m. Fed release of minutes of its last meeting. Treasurys continued to sell off and the 10-year yield held above 2 percent, well above the low of 1.88 percent it reached during Bernanke's initial statement to the committee.

The minutes highlighted what many on the street expected to see - a divide among the members of the Federal Open Market Committee on when to start to pull back on easing. But the divide seemed even larger than expected, with the minutes saying a "number" of officials were open to tapering asset purchases as early as June.

George Goncalves, Treasury strategist at Nomura Americas, said Bernanke's answer on timing seemed scripted, and as if the Fed chairman was giving the markets a heads-up. But also, "Bernanke could be throwing hawks a bone, he wrote in a note.

Traders say there had been some pricing in the markets of a possible June move by the Fed, and Chandler said the market reacted initially to the idea that that would not happen when Bernanke's initial testimony was released. But now traders are trying to figure out when the Fed might actually cut back its purchases. Chandler said tapering could be considered at the Fed's September meeting, based on Bernanke's comments, and that would mean it could start in the fourth quarter.

"We think that the communication has been poor. I don't think he really backtracked," said Marc Chandler, chief strategist at Brown Brothers Harriman. "I don't think he meant in the beginning to contradict what (New York Fed President William) Dudley says, which is three or four months. There's still no sign of tapering any time soon."

Deutsche Bank's chief U.S. economist, Joseph LaVorgna, said he thinks the economic data will force the Fed's hand sooner. "I'm of the view they could taper in September. I believe by the time we get to the August meeting, it won't matter what happened in May. By then we'll have June and July (jobs) data."

LaVorgna said the Fed chairman was more dovish than he expected. "I think the Fed is really overdoing it. Bernanke sounds really dovish. That's not really surprising but a little more dovish than I would have guessed. I still think policy is miscalibrated," he said.

—By CNBC's Patti Domm. Follow her on Twitter @pattidomm