TUESDAY JUNE 4TH

Headwinds may start to blow on Tuesday. "We may have a real problem Tuesday evening when Dallas Fed President Fisher speaks on monetary policy in Toronto," Cramer said. "Fisher's a terrific guy but he's known as a real hawk so I'm expecting him to say that the Federal Reserve should be much less accommodative. That could be a nightmare for the bulls, so be prepared for the blow-back Wednesday morning," Cramer said.

Also Tuesday, Cramer will look at single stock stories such as Dollar General which is scheduled to release earnings. "The dollar stores have been the beneficiary of the explosion in the number of people who use food stamps, and I expect a very good number," Cramer said.

Also Cramer will be keeping his ears peeled for information out of conferences being held by many major investment banks. "I'm paying attention to the Bank of America Merrill Lynch Global technology conference and to the JP Morgan Diversified industries conference. "What's said may provide clues as to which companies may prosper in the second half as business improves and revenues start to flow," Cramer said.

-------------------------------------------------------

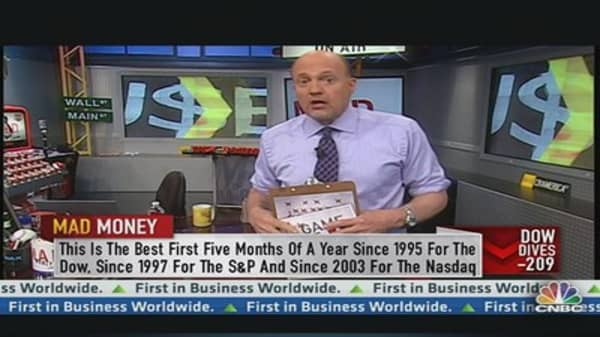

Read More from Mad Money with Jim Cramer

Cramer: Bet on the Jet Set

If This Isn't Brilliant, What Is?

Cramer's Turbocharged Bank Stock

-------------------------------------------------------

WEDNESDAY JUNE 5TH

On Wednesday jobs will take center stage with the ADP employment number. Many investors consider it to be a precursor to the Friday report released by the government, however it's not uncommon for there to be a divergence between the two. Because jobs are so important to this market, "I am going to suggest that you ignore this number entirely," Cramer said, and only focus on Friday.

Instead Cramer intends to dig down into the market for more single stock stories. "Brown-Forman, the maker of Jack Daniels, reports earnings," Cramer said. "It should be a very good number, but it might not be good enough as this is the kind of consumer staple stock this market has turned on," he said.

Also Cramer will be looking at apparel as Ascena Retail reports. "This stock has quietly moved up to above $20. With that rally I say, be careful, the company better not disappoint or we will see $18 real fast."

THURSDAY JUNE 6TH

Bulls could face serious headwinds on Thursday. "Philly Fed President Charles Plosser is scheduled to speak in Boston," Cramer said. "Shortsellers love this guy because he's been worried about inflation forever." In other words, the Street may take his comments as a sign that the Fed is about to pull back from its bond buying program. "Be prepared for his 8 a.m. talk to send the market lower," Cramer said.

Also Cramer will be watching Europe. "There's an ECB meeting. Wouldn't it be great if the Europeans would roll back that second rate hike they put through when Trichet thought Europe was about to roar."

FRIDAY JUNE 7TH

Perhaps no day matters more next week than Friday; the government will release the jobs report. "The consensus right now is for 7.5% unemployment and 170,000 jobs created."

Cramer, however, is concerned that good news may be bad news for stocks. "If the number comes in better than expected, say 200,000 jobs created, the Street may fear the Fed is about to pull back. If that's the case, I suspect stocks could get slammed."