Take note, Ben Bernanke: Japan is what happens when a market demanding constant central bank stimulus doesn't get what it wants.

The Federal Reserve chairman no doubt is paying attention as the massive surge in the Japanese equity market has whipsawed lower after investors became concerned that Abenomics might come up short in goosing the economy.

Similar to the U.S. central bank, the Bank of Japan, at the urging of Prime Minister Shinzo Abe, promised to pump liquidity into the economy at a pace even faster than the Fed.

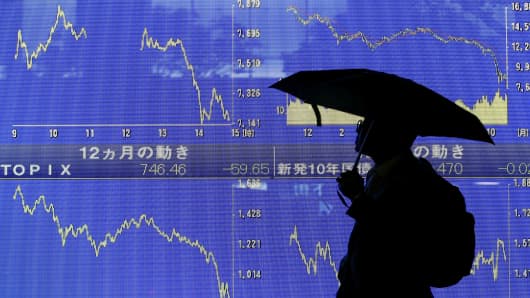

But in recent weeks indications have been that the quantitative easing from Japan may not be as big as hoped. Consequently, there's been a huge sell-off that has taken the Nikkei into bear market territory.

(Read More: Nikkei Plunges 6.4%; Re-Enters Bear Market)

"Many would characterize it as an overreaction, but it's probably an overreaction to what central banks are doing," Zane Brown, fixed income strategist at Lord Abbett, said during a panel discussion Thursday that focused on the so-called Great Rotation of cash from bonds into stocks.

The panel, assembled by institutional equity firm Liquidnet Holdings, unanimously agreed that the move from fixed income shows signs of occurring but has not happened yet.