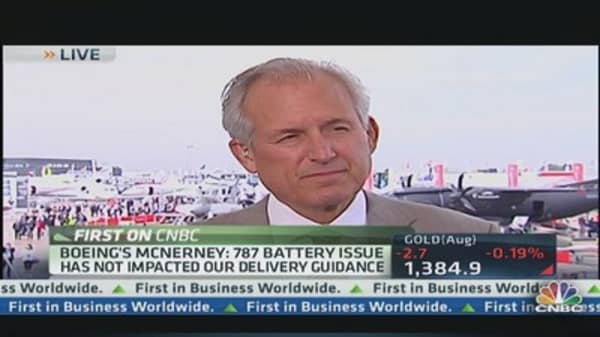

The Federal Aviation Administration did "everything right" in the dealing with the battery issues that grounded Boeing's new 787 Dreamliner for months, the aircraft maker's chairman and CEO James McNerney told CNBC on Monday from the Paris Air Show.

He said in a "Squawk Box" interview that he's "highly confident" in the overhauled lithium-ion batteries. "We re-examined the technology as we learned more," he said. "We have a very robust fix and a next generation battery system that, I think, will serve this airplane well for the future and other generations of airlines."

In January, the FAA launched its review of the lithium-ion batteries in the 787s after one caught fire in a parked Dreamliner in Boston that month. A second battery overheated and smoked during a flight in Japan about a week later—prompting regulators to ground the worldwide fleet for four months, while Boeing altered and recertified the battery system. The 787s went back into service last month.

The battery problem has not affected Boeing's delivery guidance of at least 60 787s this year, McNerney added. "[It] will not impact our delivery stream because we kept producing as we went through the fix." There could be some upside to that forecast, he said.

"We [also] have a product line that is unsurpassed. We've got more choice in the wide-body space," he said, referring to, what he believes is, the value-proposition of Boeing over its rival Airbus of Europe.