An influx of rich Europeans to London is causing the cost of living for the ultra-wealthy to surge, a top private wealth management firm reported on Monday.

The price of "typical" luxury goods and services in London rose by 4.9 percent in the 12 months ending April 2013, more than double the 2.4 percent rate of general U.K. consumer price inflation, said Stonehage. The firm, which bills itself as "the leading European multi-family office for ultra-high-net-worth families and entrepreneurs", calculated the cost of living for its clients using its own Stonehage Affluent Luxury Living Index (SALLI).

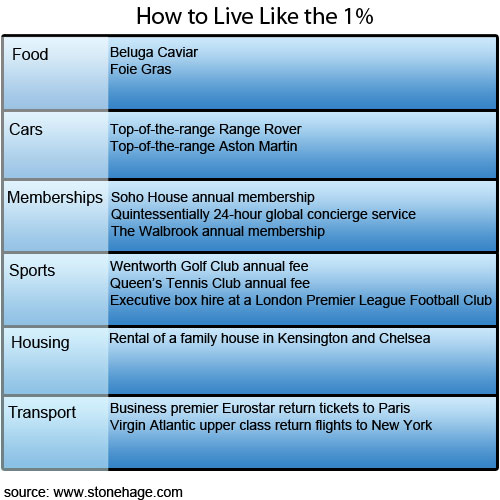

A top-end Aston Martin featured as a "typical" car in the SALLI index, which consisted of six components: consumables, culture and entertainment, sports and recreation, housing and family, consumables and "investments of passion" such as cars, watches and jewelry.

Beluga caviar and foie gras featured in the consumables section, while more prosaic items such as private school fees, rental accommodation and private healthcare (encompassing Botox treatments) were also on the list.

"The increase in SALLI shows that consumer confidence among the ultra-wealthy in London has risen, following a surge of wealthy families to the capital including those from countries where relatively harsh tax conditions, together with economic and political pressure, are having a negative impact on their lifestyle," said Ronnie Armist, executive director at Stonehage Investment Partners, in a report on the findings.

Talk of tax hikes for the wealthy, coupled with public and political fury over recent tax evasion and bonus scandals have fueled concerns that Europe is becoming less hospitable for the rich. While the U.K. is far from immune, its position outside the euro zone, combined with London's status as the financial hub of Europe, mean it is viewed as a comparative oasis.

(View More: Taxes for Wealthy Top 100%)

'Investments of Passion' Fuel Luxury Inflation

The uptick in 2013's SALLI index, came after a 1.6 percent decrease in the previous year. "SALLI 2013 reinforces findings that ultra-high-net-worth inflation is much more volatile than CPI [consumer price inflation], tending to exceed standard inflation in good times and significantly fall short in times of downturn," said the report.