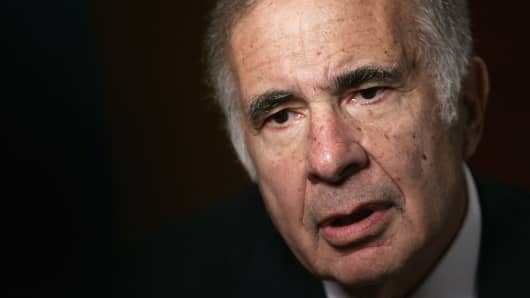

After an encouraging word on Monday from Dell welcoming Carl Icahn's newly fortified bid for the computer maker, the billionaire investor said now is a good time for a contrarian view on PCs.

"There's a lot of drum-beating that the PC business is falling apart," he told CNBC's "Closing Bell."

"But what I've found over the years is that when people tell you it's no good, that's when you buy." He argued that despite the trend toward mobility, a brand like Dell will have staying power in office places.

Dell's special board committee said Monday that it welcomes Icahn's newly fortified proposal, which lines up $5.2 billion in loan commitments to back up his bid for a leveraged recapitalization of the company.

"The Special Committee has reviewed Mr. Icahn's open letter and will be pleased to review any additional information, including financing commitments, that it may receive from him regarding his recapitalization proposal," said a statement from Dell. "The Committee remains committed to achieving the best outcome for all Dell shareholders."