Back on June 28th, Cramer called Paychex earnings commentary a wake-up call.

At that time, the chief financial officer, Efrain Rivera said that to generate the kind of growth Wall Street would like to see 'there needs to be a slightly different environment in terms of new business formation.'

The Street interpreted the comments to mean Paychex isn't getting the volume of small business clients that they should be getting if the economy is truly starting to turn a corner.

And small business may be at the epicenter of the recovery. According to the Small Business Council, firms with fewer than 100 workers employ 34.9 percent of private sector payrolls.

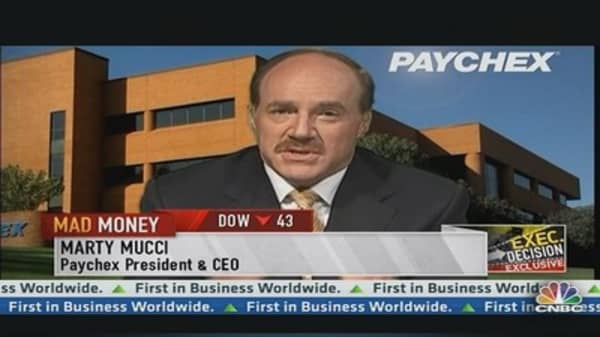

There may be some reason for optimism, however. Paychex CEO Martin Mucci tells Cramer, "I am pleased with housing – price are up and inventories are down – as new houses are built a lot of jobs come around."

Turning attention to Wall Street expectations, Reuters says that on average the Street is looking for nonfarm payrolls to come in at 165,000 last month.

While the anticipated rise would be a bit below May's tally of 175,000 jobs, it would be higher than the monthly average of 155,800 over the past three months. The unemployment rate is expected to fall a tenth of a percentage point to 7.5 percent.

"Don't forget that Thursday is Independence Day," reminded Cramer. "Trading will be thin due to the holiday so the important thing to consider is that the reaction will be wildly disproportional versus other non-farm payroll reports."

------------------------------------------------------

Read More from Mad Money with Jim Cramer

Cramer: Easy Money Over, Time to Ring the Register

Cramer: Don't Get Dinged by Market Blind Spot

Cramer: This Stock Gained 200% YTD

------------------------------------------------------

June's employment report will come two weeks after Fed Chairman Ben Bernanke said the U.S. central bank expected to trim its bond purchases later this year and to halt the program by mid-2014, as long as the economy progresses as it expects.

The Fed has said it expects the jobless rate to drop to around 7 percent by the middle of next year, when it anticipates ending the bond purchases it has been making to reduce borrowing costs and spur stronger economic growth.