Investors have welcomed the latest dovish comments from the chairman of the U.S. Federal Reserve, but one nuance of the minutes of the central bank's last meeting has got some analysts wondering whether the tapering of U.S. monetary policy will culminate in an end to asset purchases by December.

"There is a hint in the minutes that the tapering might be a short-lived process," Robert Mellman, senior U.S. economist for JPMorgan said in a research note on Wednesday evening.

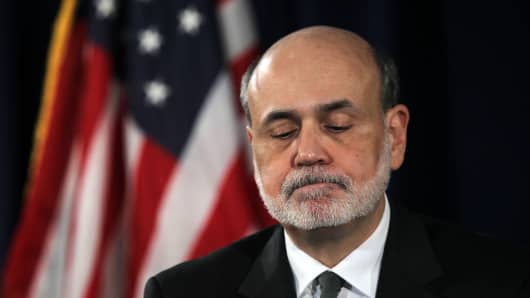

The Fed released minutes from its June meeting last week when Bernanke outlined a roadmap on how the bank's $85 billion a month asset purchases could be wound down later this year. On page nine, in the Fed's economic projections it hinted that a sizable portion of Fed members would like to see quantitative easing (QE) end, not slow, before the year is out.

(Read More: Fed Easing of Stimulus Could Hamper European Recovery)

"Given their respective economic outlooks, all participants but one judged that it would be appropriate to continue purchasing both agency MBS (mortgage backed securities) and longer-term Treasury securities. About half of these participants indicated that it likely would be appropriate to end asset purchases late this year."

The wording has economists at Nomura equally puzzled. Some of the details in the minutes do not match some of the comments made by Chairman Bernanke in his post-meeting press conference, the bank said in a research note.

"The Summary of Economic Projections noted that 'about half' of FOMC (Federal Open Market Committee) participants expected asset purchases to end by the end of this year, which is at odds with the Bernanke's statement that a 'consensus' of the committee was that asset purchases would likely extend into the middle of 2014," Nomura economist led by Lewis Alexander said in a research note on Thursday.

(Read More: What Did Ben Say? Playing the Fed Word Game)

"In addition, there was no mention in the minutes of the final termination of the asset purchase program being associated with an unemployment rate of 7 percent, as the chairman discussed in his last press conference."