Elsewhere:

1) while U.S. stock indices are sitting at historic highs, money is continuing to leave emerging market countries...big time. Emerging market stocks are up this morning in the first significant rally for a while. Still, there has been enormous damage already done.

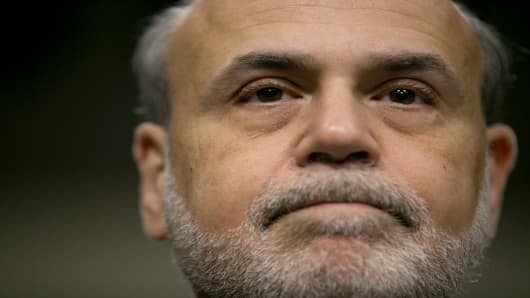

Some of this is due to worries over a China slowdown, but the real move began when Bernanke first hinted at tapering on May 22nd. Some of the Fed's ocean of liquidity clearly found its way into emerging markets, and that is now coming out.

Here's the performance of a few major emerging market ETFs since May 1:

Turkey -25%

Peru -21%

Thailand -21%

Philippines -19%

Meanwhile, two emerging market central banks raised rates: Brazil raised from 8 to 8.5 percent, and Indonesia hiked from 6 to 6.5 percent— all in an effort to stem the flow of money out, so far to no avail.

2) June Retail Sales up 4.1 percent, according to RetailMetrics, strongest since January, again indicating that retail continues to hold up. Standouts were Costco, where sales rose 6 percent, discounters like Fred's and Steinmart and PriceSmart were also strong.

The one downside standout was L Brands, which had a flat comp, below expectations of a gain of 2 percent. This could be setting up for a decent back to school shopping season, which starts in 3 weeks (wait, didn't the summer just start?)

3) Bulls are on the move: the individual investor measurement of sentiment, the AAII survey, up strongly this week, to 48.9 from 42.0, the highest since January 2013. Bears fell to 18.3 from 23.8, the lowest since January 2012.

—By CNBC's Bob Pisani