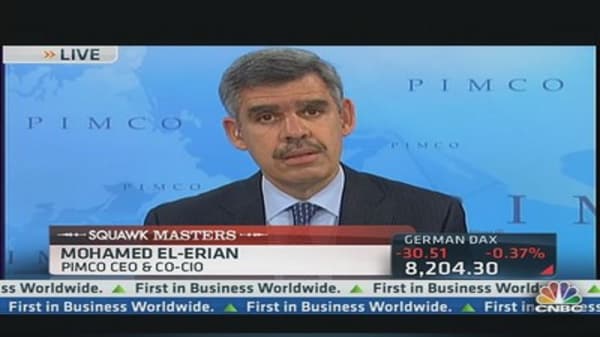

Pimco's Mohamed El-Erian is scratching his head about where the Federal Reserve is getting its projections for U.S. economic growth.

"We are still looking at a growth rate of 2 percent," the Pimco CEO and co-CIO said Tuesday in a "Squawk Box" interview. "Remember, we're tracking at 1.2 percent for the second quarter with 80 percent of the data in. So we're going to have to pick up next quarter, and the one after, to get to 2 percent."

In its economic projections—released after the June policy meeting—the Fed put the growth rate for this year at between 2.3 percent and 2.6 percent.

El-Erian said he doesn't know where the Fed gets its projections because the "new normal" of slow economic growth, high unemployment, and government debt problems is persisting. "We continue to heal," he added. "But we're not at escape velocity."

Back in January, El-Erian told CNBC the "new normal" may be nearing an end. Pimco coined the term in 2009.

(Read more: 'New Normal' May Be Nearing End: Pimco's El-Erian)

Meanwhile, investors will be looking for more clues on growth from Fed Chairman Ben Bernanke on Wednesday and Thursday, when he goes before Congress to talk about the economy—and by extension, the possible timing for tapering the central bank's $85-billion-a-month bond-buying program.

"[Bernanke] is going to try to do a high-wire act without the excitement," El-Erian predicted. "He's just going to try to convey he's data-dependent, he's flexible, he's adaptable, and he's going to try to not rock the boat."

That certainly didn't turn out to be the case on May 22, when Bernanke sent stocks plummeting with comments that the central bank could scale back its bond purchases later this year provided the economy improves.

Then Bernanke didn't help matters when he reiterated those sentiments on June 19 after the Fed's latest policy meeting.

Maybe it was a case of "third time's the charm," because on July 10, the Fed chairman by most accounts said basically the same thing at an economic conference. But this time stocks soared—and eventually tracked to new closing highs again.

"The Fed wants to taper for two reasons," El-Erian explained. "One, [is] they have a more optimistic view of the economy. That's good."

"Two, is they're worried about the costs and risks, or collateral damage and the unintended consequences. So there are two things that they're trying to fulfill with one instrument," he continued, "and that's why the market becomes so volatile."