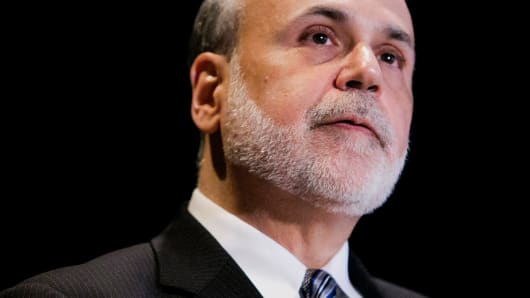

It's a big day for Big Ben, and gold should respond accordingly.

Look for gold to fish for stops above last week's $1,297 high, as it tests $1,300 upon the release of the text of Chairman Bernanke's prepared remarks to the House Financial Services Committee. These remarks helped bond prices and equities rally, in addition to gold.

(Read more: Stocks modestly higher as Bernanke speaks; All S&P sectors gain)

Investors are eager to see gold back above $1,300, after Bernanke said just last week that a highly accommodative monetary policy will remain in place for the foreseeable future. One has to question, though, what this really means.

As Bernanke appears before the House Wednesday to present the Federal Reserve's semiannual monetary policy report, the main topic of discussion will be the Fed's potential exit of the $85 billion monthly bond-purchasing program. The other big topic on the table will be the benchmark interest rate.