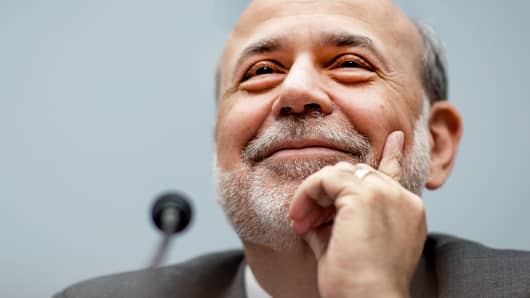

Ben Bernanke emphasized in his second day of Congressional testimony that monetary policy will not be tighter for the foreseeable future and that it's too early to tell when tapering will begin.

"We have not changed policy. We are not tightening policy," Bernanke said during the question and answer session. He added that none of what the Fed has communicated about winding down its bond purchases implies tighter policy any time soon.

Bernanke again tried to draw the distinction between paring back bond purchases and raising interest rates, implying that policy will remain accommodative even if the Fed ends quantitative easing since rates will remain near zero.

"With inflation below target and with unemployment still quite high—and by some measures with unemployment in some ways being even too optimistic a measure of the state of the labor market... —both sides of our statutory mandate are suggesting that we need to maintain a highly accommodative monetary policy for the foreseeable future," Bernanke said. "And that's what we intend to do."

He also said that it was too early to say when the first reduction in bond buying will happen. Bernanke said the Fed wants to see sustainable improvement in labor markets as it weighs reducing bond purchases.