Detroit needs a "clean slate" to begin rebuilding, even if that means tearing down tens of thousands of buildings, mortgage magnate and leading Detroit landowner Dan Gilbert said Friday.

Facing at least $18 billion in debt, Detroit filed the largest municipal bankruptcy in U.S. history Thursday. The city's emergency manager said it had no choice but to file after failing to come up with some sort of consensual agreement.

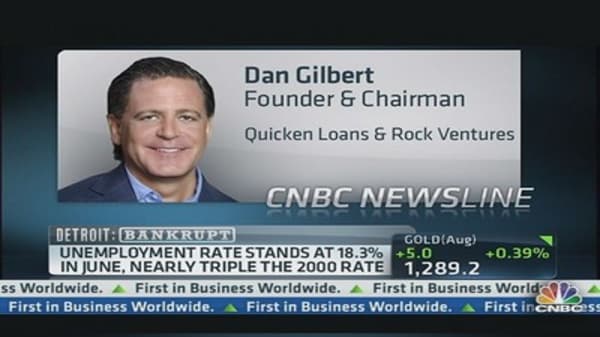

Gilbert is the founder of Quicken Loans, which has about 9,200 employees in Detroit, and one of the city's largest single landholders, with more than 30 properties in the downtown area and about a billion dollars invested. (Gilbert also owns the NBA's Cleveland Cavaliers.)

"There's something like 128,000 buildings, commercial and residential, that need to be removed. And once that happens, there's going to be opportunity...where developers and people can start making investments again," Gilbert told "Squawk Box" on Friday.