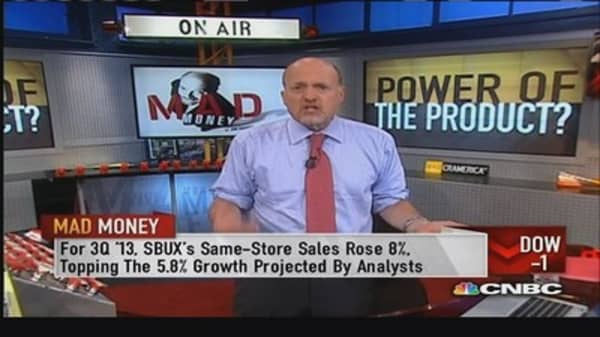

"Look at Starbucks," he said. "They've taken coffee, which should be a commodity, and they turned it into a proprietary product." In other words, customers view Starbucks coffee as superior to rivals. Cramer believes that's why Starbucks just reported its best across-the-board Q3 results in its 42-year history.

Proprietary.

Celgene is a similar story. The drug maker posted strong cancer drug sales for the second quarter, topping Wall Street expectations, and they raised earnings guidance for the remainder of the year. "Celgene keeps hitting new highs because there is no price competition for their one of a kind offerings," Cramer said.

Again proprietary.

Conversely, anybody can make fertilizer," Cramer said. "Today the market learned that Uralkali, a Russian maker of potash plans to flood the world with cheap potash. That's a problem for rivals such as Potash, Agrium and Mosaic. Their products are not proprietary," Cramer said.

Commoditized.

"Few goods are less proprietary than carbonated soda," Cramer added. Although Coca-Cola earnings were in-line, the beverage maker cited a challenging global economic malaise and bad weather for its lackluster performance. Since reporting, the price action in this stock has fizzled out.

Again commoditized.

-----------------------------------------------------

Read More from Mad Money with Jim Cramer

3 mergers Cramer doesn't want you to miss

'This' earnings report really impressed Cramer

Are these stocks 'too dangerous' to hold?

-----------------------------------------------------

These are but a few of the many examples Cramer cited on Tuesday's broadcast. And he said that he expects the theme to play out for quite some time.

Therefore, before putting money to work Cramer thinks the best thing you can do is ask yourself the following: "Can anyone make this company's product? Is there anything different about it that can't be duplicated?

If the answer is no, then Cramer is a buyer. However, if the answer is yes, Cramer says proceed cautiously, "Or you could find yourself rushed by a huge heap of foul smelling earnings disappointments."