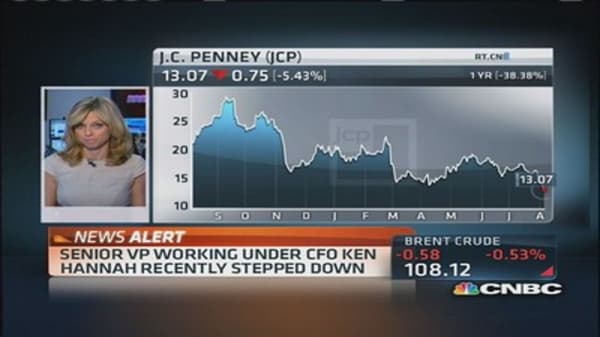

It's already been a tough August for J.C. Penney. But big traders are betting that things will get worse before they get better.

J.C. Penney is a struggling department store chain that has suffered from poor management, and is currently trading at a low it has not seen since 2001. When the company decided to replace former CEO Myron Ullman with Ron Johnson (the man behind Apple's very profitable stores) in November 2011, the stock soared to highs it had not seen since before the financial crisis.

But Johnson was unable to turn JCP around, and instead of focusing on new avenues for revenue (such as the Internet), focused on the pricing strategy, which had previously been coupon-driven. The board was frustrated with the performance, and rehired Ullman—which resulted in an immediate 10 percent drop in the stock price.

As of Wednesday, JCP has been down for the past seven consecutive trading days, and the future of the company looks pretty grim. Last week there were rumors of a credit cutoff by CIT Group to some of J.C. Penney's vendors, which sent the stock down 10 percent for that day. The New York Post, after reporting the original news (which JCP denied), consequently said CIT's "clamp" had been lifted, but that wasn't of much help to the battered stock.

(Read more: Citi downgrades JC Penney stock to 'sell')

JCP has traded all the way down to $12.50, meaning it fell more than 60 percent from the 52-week high. Big-name hedge fund managers George Soros and Bill Ackman have been in the news backing the company and citing the potential for growth, but it's the short traders on the other end of those positions who have been raking in the profits.