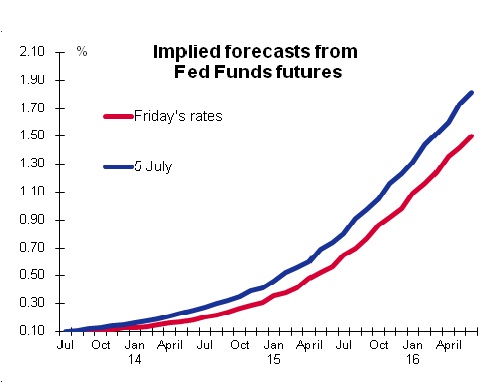

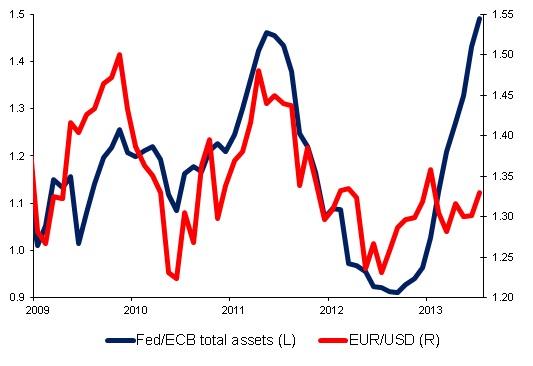

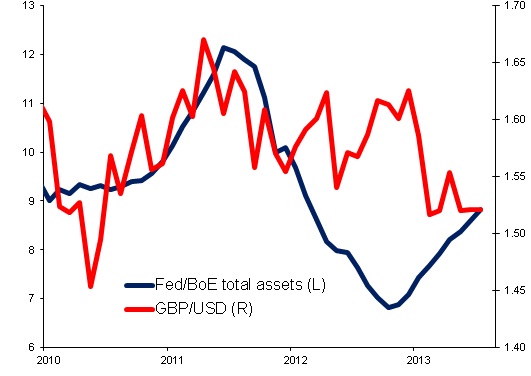

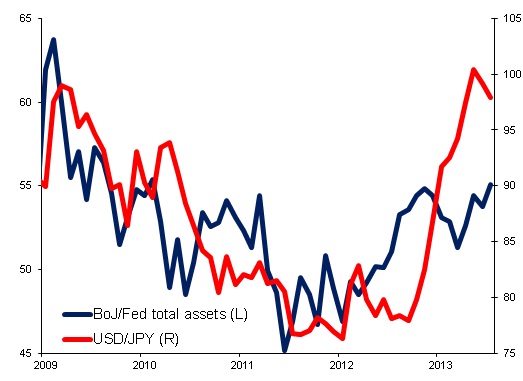

I've been wondering recently: why is the dollar falling? This question disturbs me a lot, because frankly, I thought it was going to continue to rise based on the divergence in monetary policy between the Fed and the other major central banks.

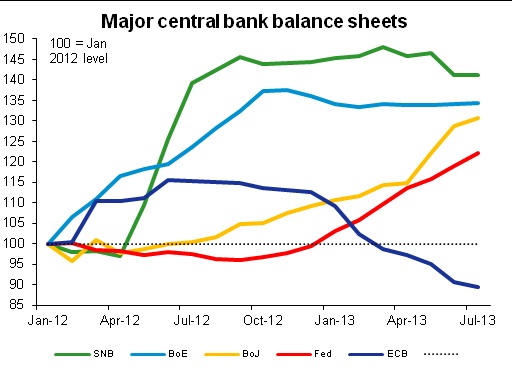

But as it turns out, there is a difference between what the other central banks say and what they do. While the Fed is openly debating whether to begin tapering off the pace at which they expand their balance sheet, in fact several other major central banks have already started shrinking their balance sheets.

(Read more: Blame the Fed for the floundering dollar)

That may prove to be a headwind for the dollar for some time until the difference in monetary policy reasserts itself, probably in the first instance by those central banks that have stopped expanding their balance sheets taking other measures to loosen policy.