(Click for video linked to a searchable transcript of this Mad Money segment)

If there was a Rodney Dangerfield of stocks, Jim Cramer says it would be this.

"It just doesn't get enough respect," Cramer said.

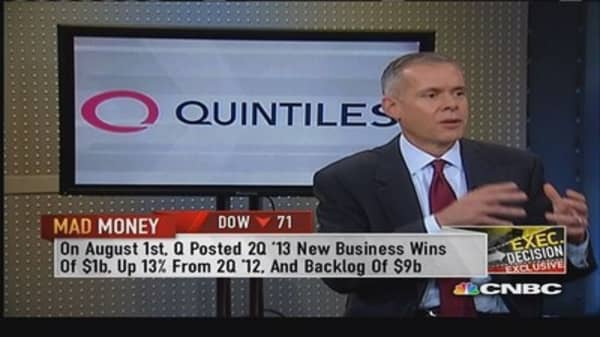

Although the business is somewhat complex, Quintiles is essentially a firm to which pharma companies outsource their clinical trial work.

"You should know that Quintiles is the largest player in this space. They've helped to develop or commercialize all of the top 50 best selling drugs out there," Cramer explained

And Quintiles is best known for the work on phase 2,3 and 4 clinical trials – "that's the sweet spot of where the big pharma players are spending their R&D budgets right now," Cramer added.

Looking at the price action, the Street is indifferent, at best.

"Quintiles just came public in May—the stock popped just 5% in its first day of trading, and it's rallied a little more since then," Cramer said. Nontheless, gains don't seem like much when you consider the strength of other IPO's this year.

However, Cramer think the indifference is misguided. He's crunched some numbers and sees a great deal of potential.