We could be witnessing the beginning of a merger wave in biotech, where smaller firms are acquired by big drug companies looking for a new source of growth, Jim Cramer said Tuesday.

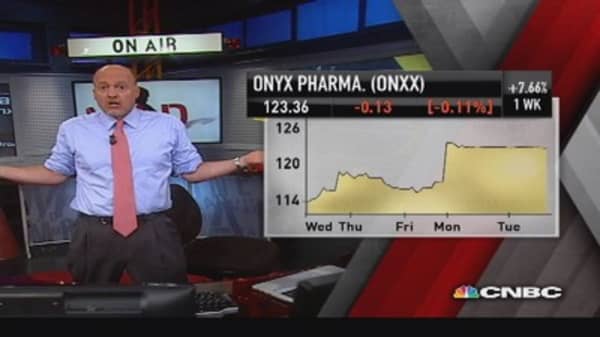

Amgen's $10 billion takeover of Onyx Pharmaceuticals, in addition to Gilead Sciences' acquisition of Pharmasset two years ago, shows that these mergers are a "win-win," the "Mad Money" host explained. Amgen rallied 7 percent on the merger news Monday, and Gilead is up 226 percent since the deal was announced in November 2011.

So who's next? Cramer thinks there are three candidates that stand out as possible acquisition targets.

Medivation

This $4.25 billion biotech launched a prostate cancer drug, Xtandi, in partnership with Astellas Pharma about nine months ago.

So far, the news is good—patients who took the drug survived an average of 4.8 months longer than patients with a placebo, and taking the drug led to a 37 percent reduction in the risk of death. The drug has already generated $230 million in sales, and could ultimately hit $2.2 billion in sales in 7 or 8 years.