Europe must make a decision as soon as possible on setting up a strong central authority to handle failing lenders, a key plank of establishing a successful banking union, former European Central Bank (ECB) president Jean Claude Trichet urged on Thursday.

Although European Union lawmakers earlier this month granted new powers to the ECB to oversee banks in the euro zone, the challenge of setting up a single euro zone authority to handle failed banks remains.

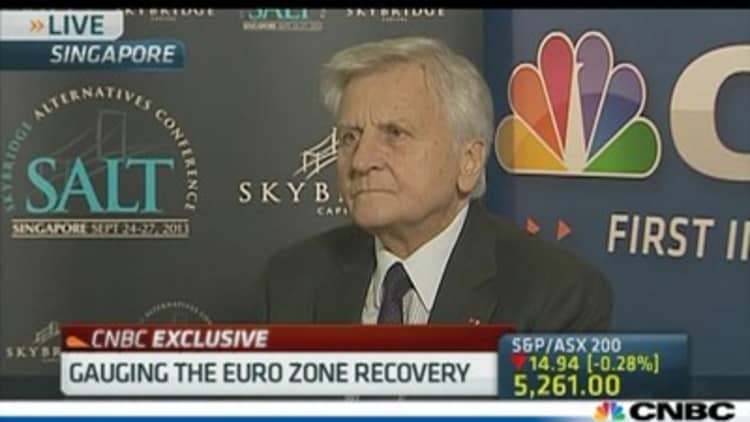

Trichet, speaking to CNBC on the sidelines of the SkyBridge Alternatives (SALT) conference in Singapore, said establishing such a body was crucial.

(Read more: Europe's banks face $95 billion funding shortfall)

"We do not yet have a decision on the single resolution authority and that is extremely important," said Trichet, who was president of the ECB between 2003 and 2011.

"I expect that this decision will be taken in the next few weeks or month and I would call for this to be done as soon as possible, because to have a real banking union we need both," he said referring to the supervisory body and resolution authority.

The banking union establishes new rules for bank supervision and dealing with bank failures to avoid government bailouts.

(Read more: Peripheral bonds: How to play Europe's recovery)

It follows over three years of turmoil in the euro zone following bailouts for Greece, Ireland, Portugal and Cyprus and is seen as a key step to limiting financial risks in the single-currency zone.

Trichet added that the position of commercial banks in Europe was better than perceived.

(Read more: Europe at a turning point: This chart shows why)

No time for complacency

Recent economic numbers have painted a brighter outlook for the euro zone economy, with data earlier this week showing business activity in the region grew faster than expected in September.

The former ECB chief said that while he was pleased with signs of a recovery, this was not the time for complacency.

"[The recovery] is good because we have black figures and not red figures now and I expect, like the consensus of most institutions, that we will post growth of around one percent next year," Trichet said.

(Watch now: Former ECB boss: Europe must not be complacent)

"We have to do all we can to make [the economic rebound] more sustainable and more convincing, so this is not a time for complacency," he added.

Asked about his reaction to last week's unexpected decision by the U.S. Federal Reserve not to taper its $85-billion-a-month asset-purchase program, Trichet said he trusted that the central bank had taken the right action.

"The FOMC [Federal Open Market Committee] knows where it is with its problems; I trust it took the right decision," he said. "That being said, it is clear that the unconventional methods taken in Japan the U.S, Europe are transitional, they cannot last forever."

—By CNBC.Com's Dhara Ranasinghe; Follow her on Twitter @DharaCNBC