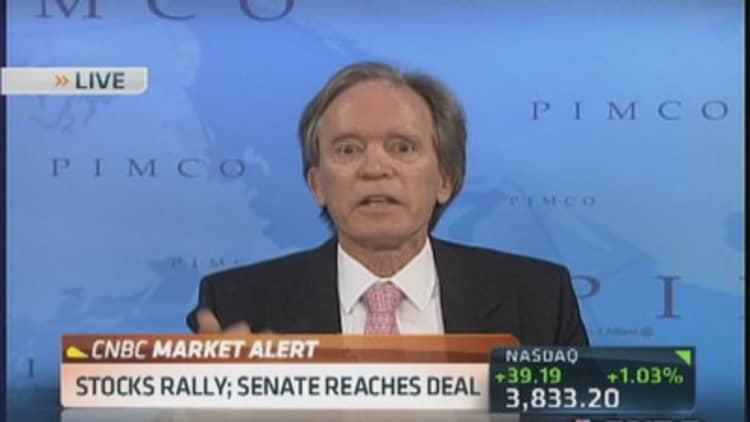

Though Senate leaders on Wednesday agreed to a deal that would end the partial government shutdown and avoid a debt default, Pimco founder Bill Gross warned Treasury investors that this type of gridlock is likely here to stay.

"Dysfunction in Washington appears to be a permanent disease that ultimately should concern longer-term Treasury investors as to the volatility of Washington's debt," Gross told CNBC's "Street Signs."

In terms of Congress coming to a deal, he said the team at Pimco wasn't worried.

"The Treasury only had an interest payment on Oct. 31, it didn't really have anything to pay for the next two weeks, so the Oct. 17 [deadline] was sort of a red herring," he said.

"We were buying Treasury bills at 40 to 50 basis points. On $1 billion, as I've suggested before, does that mean a lot? A few thousand bucks but we were glad to buy them from BlackRock and Fidelity and to pick up those pennies which is something an active manager should do," he said.

Pimco is the largest manager of money market mutual funds in the U.S. The firm has nearly $2 trillion in assets under management.

(Read more: Buffett: Debt limit is 'political weapon of mass destruction')

Two weeks ago, Gross told CNBC the possibility of default on the part of the U.S. Treasury was "a million to 1, and perhaps even in the billions."

Gross warns that every time there is crisis like this recent gridlock in Washington, treasury yields go up and that costs the government and American taxpayers money. He said Treasury yields have increased 5 to 10 basis points because of this crisis.

"What does 5 to 10 basis points mean on $15 trillion worth of debt? It means about $15 billion a year so it's a lot of money," he explained.

With the government shutdown and debt ceiling crisis nearly behind the markets, many are wondering if "taper talk" will return, if investors will get back to debating when the Federal Reserve would begin reducing its bond buying program designed to bolster the economy.

"Because of the debt crisis and potential settlement here in the next few hours, it seems to us that because the economy has been subtracted in terms of GDP by perhaps two to three-tenths in this particular quarter, that the Fed is going to take a look-see perhaps at their next meeting and not taper again," he said.

(Read more: Despite DC deal, market rally could be cut short)

Gross said the Fed has to end its quantitative-easing program in the next few years but what's important is what takes its place.

"We think that Janet Yellen as the new chairperson will institute a policy of forward guidance in which she guides forward the policy rate, the 25-basis-point policy rate, into late 2015, maybe even 2016, and that stabilizes the front end of the Treasury curve and that's what we've been buying," he said.

—By CNBC's Katy Byron. Follow her on Twitter @kbyronCNBC