Gold settled more than 3 percent higher on Thursday, aided by dollar weakness and belief that a temporary deal to avoid historic U.S. debt default might also prompt the Federal Reserve to hold back from reducing its additional monetary stimulus.

Unusually for early European trading hours, significant volumes were also seen on COMEX gold futures with over 17,000 lots traded in 10 minutes alone.

Spot gold surged to $1,321 per ounce up more than 3 percent on the day, while for December delivery settled 3.2 percent higher at $1,323.00.

The dollar slid against a basket of major currency rivals, and was last down 1 percent, with dealers citing the budget deal and a report that Chinese rating agency Dagong downgraded the United States to A- from A.

Congress passed a last-minute deal to avert a debt default for now, with analysts saying weeks of uncertainty that knocked investor and business confidence would have dented growth prospects for the world's largest economy.

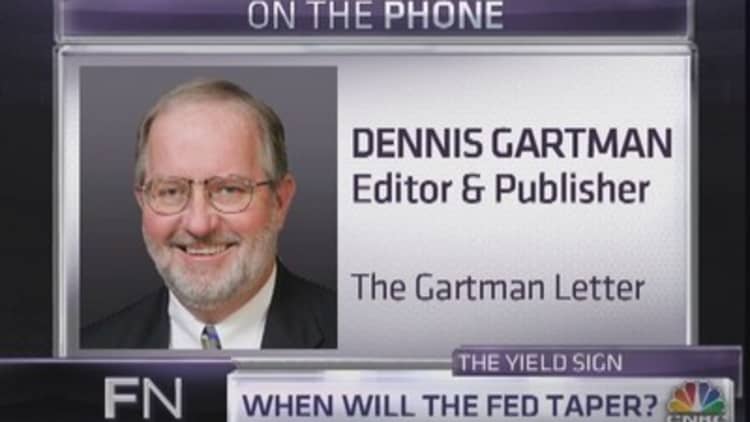

For gold market participants the temporary budget deal was seen as a positive for prices as it would keep the Federal Reserve from withdrawing monetary stimulus at least until the beginning of next year.

"Tapering will be postponed much further, so that's probably the main aspect behind the current spike in prices,'' Commerzbank analyst Daniel Briesemann said.

But while the immediate impact for prices was positive, most were realistic on gold remaining very much in bear territory overall, with an improving global economic picture contributing to investors exiting the market.

For more information on precious metals, please click here.