(Click for video linked to a searchable transcript of this Mad Money segment)

A handful of quarterly reports really wowed Jim Cramer.

Verizon

"So often people ask me what makes for a perfect quarter? I tell them, I want to see double-digit growth in operating income and earnings per share. Also, I want to see some significant revenue growth, strong operating cash flow and a considerable increase in margins of at least 100 basis points," Cramer said.

The Mad Money host also looks for strong customer loyalty, innovation and increased market share.

"Do you know who checked off every box listed? Verizon, that's who."

American Express

"Not that long ago, American Express seemed like it was on the ropes," Cramer said. "It had lent money without good credit checks. And it's business seemed passé, perhaps soon to be eclipsed by Paypal."

Yet beat estimates, with profits up 9% and credit card losses at historic lows. "Plus the company saw no cessation in spending through the quarter," Cramer added.

PPG

"PPG Industries is one of my absolute favorite companies," Cramer said. Don't be fooled by . It's adjusted profit and revenue topped Street expectations

"Right now, many think that there are no real opportunities for growth in the global economy. May I suggest they listen to PPG which is talking about how every major region around the world had record profits. If you innovate, you can grow, and PPG is an innovation factory."

------------------------------------------------------------

Read More from Mad Money with Jim Cramer

World's 2nd largest oil field in US?

Give this CEO a break, says Cramer

Cramer financial fave returns 40% ytd

------------------------------------------------------------

We also thought you might be interested in hearing about a handful of releases that Cramer really didn't care for.

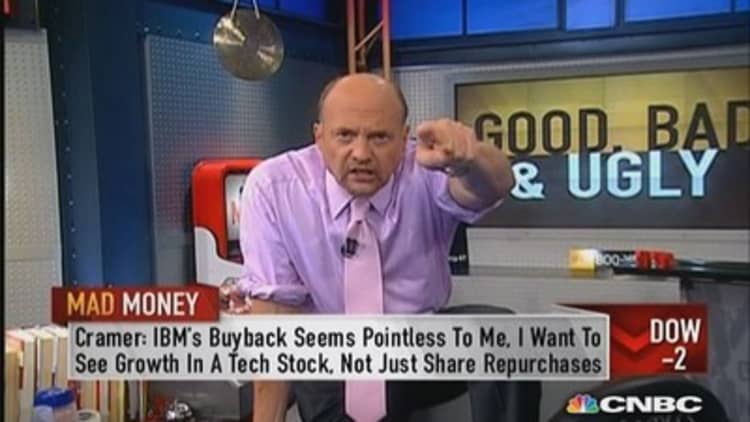

IBM

"I am aghast at what happened with IBM," Cramer said. "Here's a company with no growth whatsoever, a company that's getting its butt kicked everywhere, but particularly in high growth areas. It's a company where a resurgent China somehow produced a 22% decline in sales, with a 40% plummeting of hardware sales."

eBay

"eBay owns PayPal, yet it still reported a quarter that got progressively worse," Cramer noted. "The company used the term "decelerating" four times, twice modified by "dramatically." I found myself scratching my head."

Xilinx

"Xilinx really got under my craw," Cramer said. "They lost a huge order from Ericsson to a competitor and the guidance was tepid. Now, I'm still a believer in the story, and my charitable trust took advantage of the dip to buy. But this was very disappointing execution from a company I respect."

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com