One of the Fed's most ardent hawks may have a way out for the doves.

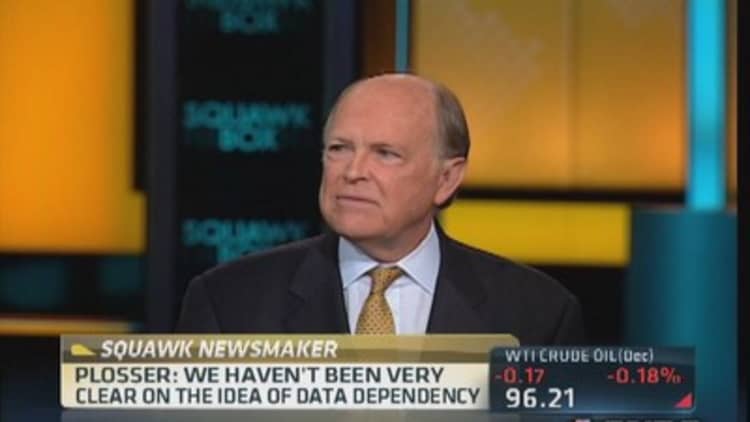

In an exclusive interview with CNBC on Friday, Philadelphia Fed President Charles Plosser for the first time called for the Fed's current stimulus program, or quantitative easing, to be capped.

This would solve several problems for the QE supporters, he said, including the apparent inability to even discuss reducing the amount of QE without a major disruption in the markets that potentially worsens the economy.

(Watch: Plosser's 'plan B' for bonds)

When the Fed announced QE2, "we said we were going to buy $600 billion and then we're going to stop and see what the economy looks like and then make another assessment," Plosser said. "I'm actually leaning to believe maybe that's a better way to get us out of this box of fine-tuning and adjusting."

The Fed prompted major market disruptions twice in the last three meetings: It surprised markets in June by announcing a timetable for reducing QE and rocked them again in September when it defied expectations for tapering the asset purchases.

(Read more: By not tapering, Fed actually increased stimulus)

Plosser pointed out that the Fed ended both of its previous QE programs without such disturbances.

The benefit of a defined amount for QE, he said, is that it would separate the market's expectations for stimulus and for interest rates. Fed officials have repeatedly insisted that the two are separate—that a reduction in QE does not mean that interest rates hikes from the Fed are any nearer. But the market has routinely treated any hint of a taper as indicating a quick rise in rates.

"It would be worthwhile for us to consider, how do we get out of this box? How do we get out of this program in a sensible way without confusing it with our interest rate program and interest rate forward guidance?" Plosser said.

"We've known for a long time how to move interest rates up and down, and the public and the markets understand that," he said. "We don't know much about how to move asset purchases up and down. And we're discovering how difficult that is."

(Watch: The Fed's impact on interest rates)

The Fed's official guidance on QE is that it depends on economic data, but Plosser complained the central bank has not been clear about what that means—in part because it can't be.

A defined QE number would eliminate the constant guessing about the Fed's assessment of the economy that inevitably leads to assessing whether the Fed might be about to reduce QE as well as raise rates sooner.

—By CNBC's Steve Liesman. Follow him on Twitter: @steveliesman