(Click for video linked to a searchable transcript of this Mad Money segment)

Does the strong jobs report mean that the economy is kicking back into gear? We may find out in the week ahead.

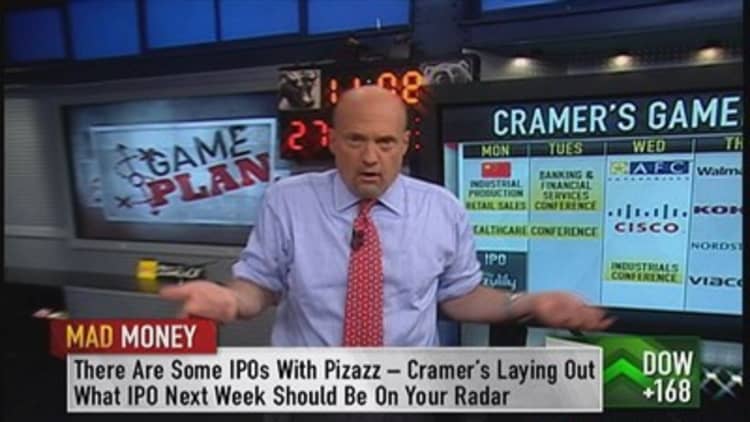

Cramer says there are a slew of conferences and a smattering of earnings which should either confirm or deny the strength suggested by Friday's Labor Department release.

"Largely, these events will provide insights on global strength and the US consumer," Cramer explained, two important catalysts that drive the economy and the stock market.

Here's what's on Cramer's radar for the week ahead.

MONDAY NOVEMBER 11

On Monday health care lands front and center with the Credit Suisse Healthcare Conference getting underway. "I'll be paying attention to the new pipeline of drugs being developed by Bristol Myers. And I want to hear if Johnson & Johnson talks about asset disposals and robust pipelines."

Also another IPO will command Cramer's attention. "Zulily goes public. It's a website for moms and kids and it's doing quite well. It's no Twitter, but it's being brought to you by the same underwriters, Goldman Sachs, so it's got good bloodlines."

TUESDAY NOVEMBER 12

Cramer plans to watch bank stocks on Tuesday as the Merrill Lynch Banking & Financial Services Conference gets underway. "I have to tell you that this is an incredibly important moment for these stocks. You see, when we got Friday's strong employment report, interest rates went higher, and when rates go higher, so too do the bank stocks. Are they positioned for higher rates? Who will make the most? I bet we find out at this conference."

WEDNESDAY NOVEMBER 13

The state of the consumer will steal the spotlight on Wednesday as AFC Enterprises reports its earnings. "That's the parent company of Popeyes Louisiana Kitchen," Cramer explained, "and I'm expecting a spicy quarter because CEO Cheryl Bachelder is remodeling stores which has been causing numbers to rise. Also, Cramer wants to hear about the company's expansion overseas; he thinks that could be another bullish catalyst.

In addition, Cramer will be closely watching results from Cisco, once considered a bellwether for the market broadly. "While I do suspect that we'll learn of weakness in government Telco spending, I think the expectations have finally been wrenched out of the stock. Therefore, I believe the Cisco's risk/reward seems pretty darned good."

Also, Cramer says the health of the global economy will come into focus with the Goldman Sachs Industrials Conference. "Important companies including Eaton, Caterpillar, Honeywell and 3M will be talking. If Europe and China are rebounding they should say some terrific things about 2014," noted Cramer.

THURSDAY NOVEMBER 14

Retails takes center stage on Thursday with three earnings reports which should speak volumes about the health of the consumer. "We hear from Wal-Mart, Kohl's and Nordstrom," Cramer explained.

After the strong employment number, Cramer expects to hear good things from all three, which would suggest the recovery is benefiting a wide range of Americans. "Now, of those three I would prefer to buy Nordstrom's if only because it has fallen behind the group. I had been nervous about apparel, but the number we got from Gap Stores last night was incredibly reassuring."

Also, On Thursday Cramer will turn an ear toward media as Viacom reports. "I think this is a terrific stock if for no other reason than the company's ferocious buyback," Cramer said.

----------------------------------------------------------------

Read More from Mad Money with Jim Cramer

Twitter IPO, sign of a top?

Growth stories called into question?

What went wrong with Tesla?

----------------------------------------------------------------

FRIDAY NOVEMBER 15

Perhaps, no other event next week will confirm or deny the jobs report quite like the industrial production numbers, released Friday. "We have had a series of very strong macro numbers of late, and I'll be watching this quite closely. I wonder if this number doesn't show incredible strength, too. You should be aware that the old Fed, under Alan Greenspan thought this number was among the most important of all," said Cramer.

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com