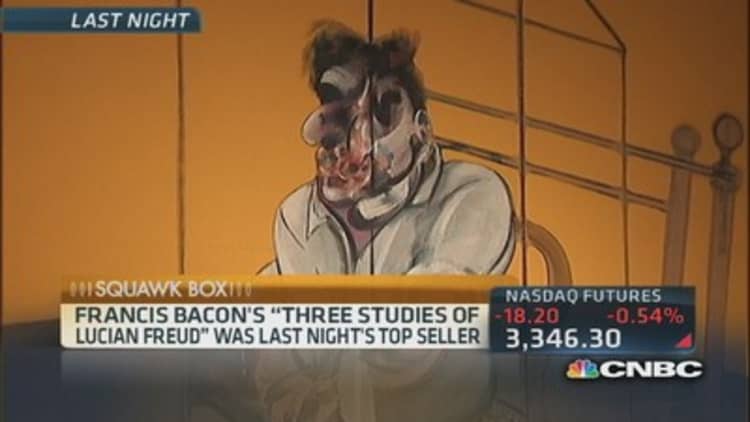

The Francis Bacon painting "Three Studies of Lucian Freud" was sold for a whopping $142.4 million as part of a $691.6 million Christie's sale on Tuesday night, making it the most expensive work of art ever sold at auction.

Some argue that the sale is giving us a message about inflation that investors aren't getting from the action in gold, the Dollar Index, or the government's official consumer price index data.

(Read more: Bacon triptych sells for record $142.4 million at auction)

"Asset inflation took another leg higher last night," wrote Peter Boockvar in a Wednesday morning note. "Thank you Federal Reserve, and thank you Bureau of Labor Statistics for not including art in the consumer price index."

The traditional measures of inflation have shown little decrease in the value of a dollar. The Dollar Index, which tracks the dollar against a basket of four other currencies, is barely higher on the year. Gold, which is thought to track inflation, is 24 percent lower. And the consumer price index produced by the Bureau of Labor Statistics shows only a small increase in 2013.

But Francis Bacon inflation is booming. In May of 2008, another Bacon triptych (meaning a three-panel piece of art) was sold for a mere $86 million. And while every work is different, the fact that the more recently sold triptych garnered 66 percent more money is notable.

By contrast, the CPI has only increased by 9 percent since then (though it may be worth noting that the price of actual bacon, a CPI component, has risen by 56 percent).

"It's indicative of the time," Boockvar, the chief market analyst at the Lindsey Group, told CNBC.com. "Stocks and bonds and rare comic books and high-end New York City apartments are all doing the same thing. What we're seeing is massive asset price inflation generated by what the Fed is doing. And while they continue to want us to look at the lack of consumer price inflation, asset price inflation is just inflation under a different name."

Of course, art might tell us even more than those other asset classes do.

"There's a great line that goes back to the first expansion of the art market in the 1980s, where someone says 'Gee, art is getting expensive!' And an artist says 'No, the dollar is getting cheap.' And that, to me, kind of summarizes what investing in art is all about," said Nicholas Colas, the chief market strategist at ConvergEx Group. "If the dollar loses value over time, that's going to leave collectibles in a pretty good spot. Anything that is rare or scarce and that people want is going to go up in value a lot."

(Read more: China's richest man snaps up $28 million Picasso art)

Colas says the art inflation is a repercussion of the Fed's $85 billion per month bond-buying program, which is known as quantitative easing or QE.

"QE has some major unattended consequences," he said, "and income inequality and wealth inequality is one of them. It hasn't filtered down to people who don't one stocks. But it has made a handful of people not just wealthy, but extremely wealthy. And at a certain point they say, 'I don't need any more stocks, I don't need any more bonds.' So they buy art."

But while Colas says that the work is probably a good buy, Boockvar believes it will end badly for the unidentified bidder.

"Those that are paying $142 million for a painting are not going to be able to sell it for that price when the Fed is out of the game," Boockvar said. "Of course, we're not going to cry for the owner of that painting. But the point is that the Fed is only influencing one small portion of the economy. And selling a painting for $142 million doesn't give the person looking for a job a job."

—By CNBC's Alex Rosenberg. Follow him on Twitter: @CNBCAlex.

Watch "Futures Now" Tuesdays & Thursdays 1 p.m. ET exclusively on FuturesNow.CNBC.com!

Like us on Facebook! Facebook.com/CNBCFuturesNow.

Follow us on Twitter! @CNBCFuturesNow.