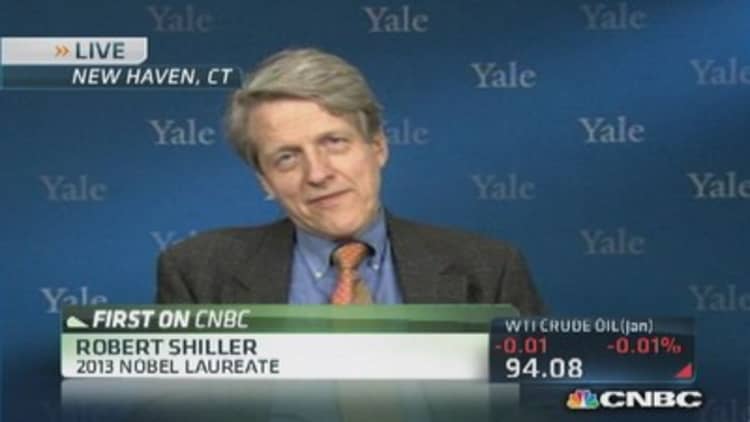

A sharp rise in U.S. equity prices could be leading to a dangerous bubble, according to one of the three Americans who won the 2013 Nobel prize for economics.

"I'm not sounding the alarm yet. But in many countries the stock price levels are high, and in many real estate markets prices have risen sharply...that could end badly."

"I find the boom in the U.S. stock market most concerning," Robert Shiller said in an interview with Germany's Der Spiegel magazine published on Sunday.

(Read More: Faber: 'We are in a massive speculative bubble')

He added that this was a key concern because the U.S. economy was "still weak and vulnerable". The real estate market in Brazil was also worrying, he said. He said that at a recent conference he attended in the country, the sharp jump in house prices had been attributed to a growing middle class and a positive economic developments.

He saw many similarities with the U.S. housing boom of the mid-2000s.

"The world is still very vulnerable to bubbles," he said.

Schiller won the Nobel prize economics in October for his research that has improved the forecasting of asset prices in the long term and helped the emergence of index funds in stock markets. He was awarded the 8 million crown ($1.25 million) prize alongside fellow economists Eugene Fama and Lars Peter Hansen.

(Read More: The Fed has created a huge global bubble: Stockman)

At the ceremony in Sweden, Schiller told Reuters news agency that the Federal Reserve's economic stimulus and growing market speculation were creating a "bubbly" property boom.

"This financial crisis that we've been going through in the last five years has been one that seems to reveal the failure to understand price movements," Shiller told Reuters.

He did not mention a bubble in U.S. stocks back in October, but has now added that to his list of growing concerns. The is now higher by 26.6 percent since the start of the year, logging its longest weekly winning streak since 2004 on Friday.

Both the Dow and the S&P 500 are regularly breaking fresh new all-time highs and the Nasdaq is trading at levels not seen since the Dotcom boom went bust in 2000.

(Read more: Art Cashin: Here are the 3 biggest risks to stocks)

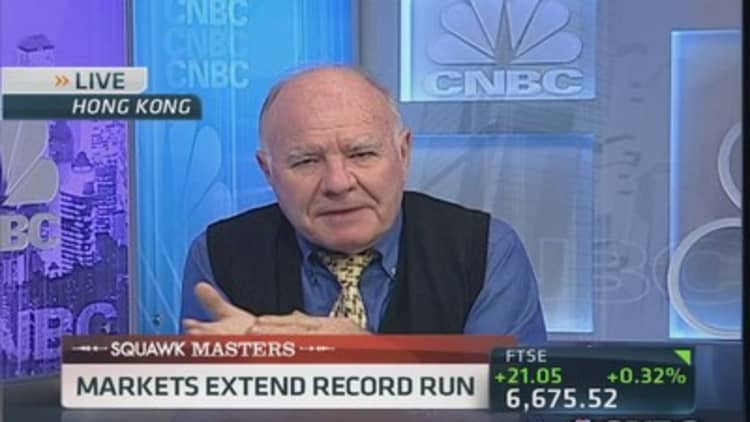

Marc Faber, editor and publisher of The Gloom, Boom & Doom Report, told CNBC on Friday he believes a "massive speculative bubble" has encroached on everything from stocks and bonds to alternative currency bitcoin and farmland. He attributed the vast bubble to "symptoms of excess liquidity."

The U.S. Federal Reserve has embarked on quantitative easing (QE) in recent years and is currently pumping $85 billion into the economy every month. This extra liquidity has been joined by similar programs in the U.K. and Japan.

Analysts cite this extra liquidity as a reason for the global equity rally this year, but many are now starting to grow cautious amid uncertainty over whether the Fed will taper its bond purchases in the coming months.

Tom Elliot, an international investment strategist at DeVere Group told CNBC Monday that fledgling U.S. growth and quantitative easing were two pillars that were currently propping up the U.S. economy. He was concerned that no-one had any idea what would happen if one of those pillars was removed.

"We've got no idea whether the wall will hold," he said.

By CNBC.com's Matt Clinch. Follow him on Twitter @mattclinch81