The surprise decision by the Federal Reserve to slow down its bond buying program was greeted by markets as a sign the economy is improving, a longer term bearish omen for bonds but a positive for stocks for now.

"I think there's a general consensus that ... what the Fed is finally signaling is that the economy is doing better," said Bob Doll, Nuveen Asset Management chief equity strategist. "In 2014, the economy will be a bit stronger and a bit better."

The Fed's move to "taper" its bond buying by $10 billion was expected by some market participants, but many had expected the Fed to wait for more data, in January or March.

Stocks initially sold off but recovered, with the Dow logging a triple digit gain. The 10-year yield initially rose to 2.92 percent but fell back to its earlier level of 2.84 percent. It then moved higher, to the 2.88 percent area.

"This is a bit of a relief trade," said CRT chief Treasury strategist David Ader. "I think it's incredibly significant that it came when we had tapering. The curve is doing very little on this."

Ader had expected a taper and said the bond market is showing the event was priced in. The Fed said it would cut its $85 billion monthly purchases of mortgage securities and Treasurys by $5 billion each starting in January.

"It's kind of a soft taper. Markets don't like uncertainty. They didn't know what the Fed was going to do," said John Canally, economist at market strategist at LPL Financial. "The Fed is agreeing with the market that the Fed can stand some tapering."

Canally said it's clear the Fed will taper the quantitative easing program in a measured way. The Fed also made clear it had not predetermined the course of asset purchases.

The landscape now changes for stocks. "Portfolios are going to be driven by earnings and economic growth, and policy is going to step to the background," said Canally.

The Fed also soothed the market with comments that it would hold the Fed funds rate low for a long time, past when the unemployment rate falls to 6.5 percent, its previous target.

"To a very mild degree the forward guidance was a tad dovish," said Ader.

The Fed's reduction in bond buying is just a tiny step away from the extraordinary stimulus the central bank has applied. The Fed's balance sheet is about $4 trillion and there are no plans to reduce that. The Fed also replaces the securities that mature in its portfolio.

"It's true that all asset prices are artificially priced and we have to be concerned about that as we move forward. What asset prices need basically is a real economy that grows at 2 to 3 percent for an extended period of time and we haven't seen that yet," said Bill Gross, Pimco co-CIO. "You know, hopefully we're going to see that and that's what the stock market is banking on today. But, you know, we still remain a little bit skeptical in terms of the Fed's approach relative to a cyclical economy boosted by asset prices. We haven't seen that in three years."

The Fed slightly increased its economic forecast, raising its expectations for GDP to 2.9 percent to 3.2 percent growth next year from a prior rate of 2.9 to 3.1 percent. It also sees a lower unemployment rate of 6.3 to 6.6 percent, from 6.4 to 6.8 percent.

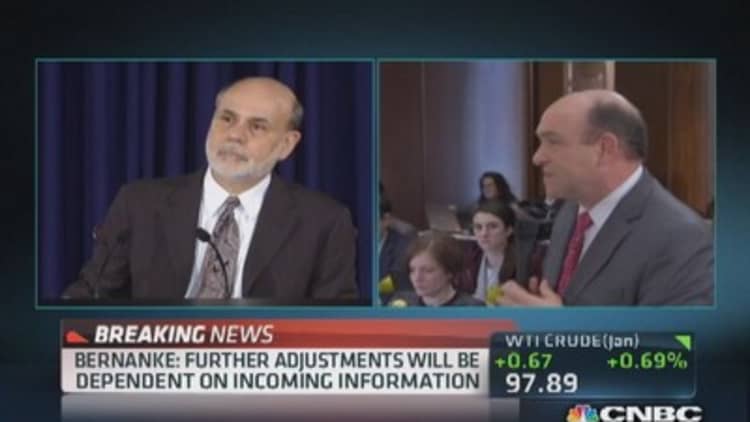

Following the meeting, Ben Bernanke, presiding over what was likely his final press briefing as Fed chairman, emphasized that the Fed will stay accommodative for a long period and that it was enhancing its commitment to hold short term rates near zero well into the future.

CNBC's Fed Survey this week found that Wall Street expected the Fed would begin to move away from its $85 billion in monthly bond and mortgage purchases in February. Fifty-five percent saw the Fed tapering in January or December, while more than 40 percent expected it in March or later.

(Read more: )

Bernanke's designated successor, Vice Chair Janet Yellen, is expected to be approved shortly, and this could be the final meeting presided over by Bernanke, who guided the Fed through the financial crisis and headed the implementation of its extraordinary policies. His term officially ends after the January meeting.

—By CNBC's Patti Domm. Follow here on Twitter @pattidomm.