How big is the global financial system that the United States is fleeing from? Let's start with the world's population. There are about 7 billion people. By 2050, the United Nations estimates that there will be 9 billion.

Roughly speaking, using International Monetary Fund data, there is about $57 trillion in convertible currencies in the world or about $8,000 in money per person. By 2050, I estimate that there will be $9,000 in money per person or $81 trillion in total.

The Bank of International Settlements tells us that on annualized basis there are an estimated $1.6 quadrillion in interest rate derivatives traded today — that's right quadrillion. Who knows what that number will be in 2050?

In this global financial system, the United States is shrinking in influence. In 1950, the United States dollar was approximately 88 percent of the world's convertible currencies. It is now 18 percent. While exchange rates are a factor in determining which country has the most money in dollar terms, it appears that the United States is no longer even in the top three.

If you look at the nine largest banks in North America by asset size, it may surprise most U.S. citizens to note that five of those banks are headquartered in Toronto. In fact, Toronto may now have more bank assets than New York. There is no regional bank in the United States as big as the top five Canadian banks. Yet, the United States has almost 10 times the number of people as Canada.

(Read more: Swiss banks prepare to bow to US demands, grudgingly)

The Industrial and Commercial Bank of China is the biggest bank in the world. In 2005, there were four U.S.-based banks that made more money than ICBC. It is my estimate that in 2013, ICBC will make more money than the two biggest profit-making banks in the United States put together.

Neither Canada nor China is attempting to shrink its biggest banks. Most countries are not. Only the United States, the United Kingdom and perhaps Switzerland are going down the shrinky-dink path. While the global financial system expands, and foreign banks regularly take market share away from U.S-based companies, it is this country's goal to run away.

Why should we care? Well one reason is that U.S. corporations are going to have to look overseas even more than they do now to finance large projects. Foreign banks will favor foreign companies — not U.S.-based international operations. The United States will give up the position of the dollar as the world's reserve currency. This latter point is the subject for another commentary but what it means is that money and commodities will cost more and the United States will be forced to actually pay down its debt.

The impact of these events on every American will be pronounced.

The shrinky dink financial system

There is an inherent belief that big banks create risk to the financial system while monoline financial companies do not. The purveyors of this theory simply refuse to look at history. They ignore the fact that the 1980s financial crisis was created by small banks. They ignore the fact that every 21 hours from 1986 to the present some small bank has left the business through merger or failure. They ignore the fact that there is no large publicly-held mortgage company; only one large publicly-held commercial-finance company; one large public credit-card company (MasterCard and Visa do not lend money) and no big auto-finance companies, consumer-finance companies, receivable-finance companies, and on and on.

They ignore the fact that these monoline companies do not exist in size for a reason. The reason is that the monoline companies, by definition, do not have multiple revenue sources. They do not have the ability to raise funds in bad times. The model simply has not worked through cycles.

Yet the government is forcing money out of the banking system where it can and is allowing the shadow-banking market to take its place. Think about this: The government is hampering the activities of the most successful banking companies in the United States and facilitating growth of financial companies in the non-regulated part of the system.

The government is driving the system to rely on its least stable companies. It is driving risk through the system. By forcing the system to rely on its weakest companies, it is insuring a major financial disaster at some future point. This only makes sense to regulators and the media, who are so blinded by their dislike of big banks that they care little what is being put in place to replace them. In terms of dealing with the root cause of the financial collapse, the government is doing nothing.

Tighter banking regulations hurt you

The regulators have forced banks to hold more capital as a percent of assets than at any time since 1938. They are demanding more liquidity at banks. The result of this is fewer loans and a $2.6 trillion build-up in cash at the Federal Reserve. The money at the Fed is there because the banks are being forced through regulation to place it there.

Tthe regulators are claiming they want to assist small business. But in the past five years, small-business loans appear to have declined, according to data released by the Federal Deposit Insurance Corporation (FDIC). Small banks are simply being devastated. For the first time in the recorded history of the U.S. banking system, we went more than two years with no one seeking to open a new bank. This did not even happen in the Great Depression.

The government has price fixed debit-card fees and specified rules as to how overdraft charges can be made. As a direct consequence, free checking is virtually gone in the United States. Moreover, the price of virtually every non-regulated banking service has increased. The new credit-card laws have resulted in a large portion of the public losing their cards and obtaining lower credit lines.

(Read more: Big JPMorgan settlement sets 'dangerous precedent')

The government has virtually charged full force at the mortgage sector. The president says that every American deserves affordable housing but that this affordable housing is not necessarily a single-family home. He believes that only rich people should get to own their own homes. This view is being driven through the whole financial system with one rule change after another.

Market liquidity has been progressively reduced. This means that commodities from corn to money will cost more. Interest rates are being held low to benefit corporations that borrow, while senior citizens eat dog food because the Federal Reserve has taken away their retirement income.

The government wants to fine miscreants in the financial system but decided to fine the Americans who own bank stocks instead. The government has now established the precedent that those guilty of financial irregularities should go free and those who are innocent — bank employees and stockholders — should be punished. This is McCarthyism at a level that the now-deceased Senator from Wisconsin never dreamed of.

The president, Congress and the banking regulators took a ballistic missile and aimed it at the banks. However, they missed the banks and hit the American people instead. And they are very proud of what they have done.

Demand for change

The banks will earn all-time record profits in 2013. In 2014, they are likely to beat that record and earn $50 billion in total. They will make more loans at wider margins with fewer loan losses in 2014.

The government did not harm the banks with its ill thought-out rules and regulations. It directly harmed every American instead. This is what "Guardians of Prosperity" is all about. It is a plea to Americans to think about how they are being harmed by out-of-control policy makers. It is a plea to change the direction of current regulation in a fashion that benefits the public and maintains the United States financial system at the top of the global financial system.

No one would have dreamed that a Chinese spaceship would be sitting on the moon right now, with China planning to build a colony there in 2020, while the United States has no prospect of equaling that effort. No one thinks that the Chinese will supplant the United States in the global financial system. If you believe that, look at the night sky when the full moon is in view and think again.

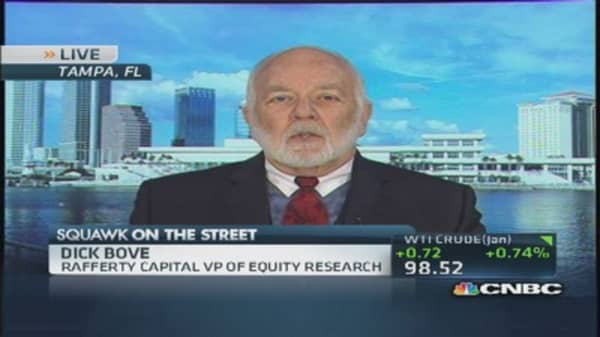

— By Richard X. Bove

Richard X. Bove is an equity research analyst at Rafferty Capital Markets and the author of "Guardians of Prosperity: Why America Needs Big Banks," which is due out on Dec. 26.