From a few stock selloffs to interconnected homes, the "Fast Money" traders have you covered in eight must-see moments from this past week.

1. Selloff to start the week

Stocks kicked off the week on a negative note, with the , S&P 500 and all falling more than 1 percent. The Dow had its worst day in over three months, down nearly 180 points.

Brian Kelly of Brian Kelly Capital said he sees more downside ahead.

"The path of least resistance for this market is still down," he said.

Tim Seymour of Triogem Asset Management took the opposite view, saying, "People are reading way too much into it."

Seymour added that "all the data over the last three months, the indications are that the data is erring to the higher."

Josh Brown of Ritholtz Wealth Management blamed the selloff on one sector in particular.

"If you look at what has generated most of the red in this selloff, its retailers, and it should be that way," he said. "The retailers disappointed, almost to a man."

2. Earnings in focus

Earnings remained in focus Monday, ahead of a number of big announcements due out during the week.

Morgan Stanley's Adam Parker joined the crew to give his best ways to play earnings season.

(Watch video: Tapering could be risk to downside: Parker)

"I think earnings season is going to be fine," he said. "I think the bar has been set low enough that the Q4 earnings that start here in earnest this week are going to be fine. I don't see it as a negative catalyst that's spooking the markets."

Despite the low bar, TradeMonster's Guy Adami said he's looking for a downside surprise out of IBM.

"Last few quarters for IBM have been, in a word, disastrous. I think you're going to see another one," he said.

3. Monday's after-hours action

Two big stories had stocks on the move in Monday's after-hours session.

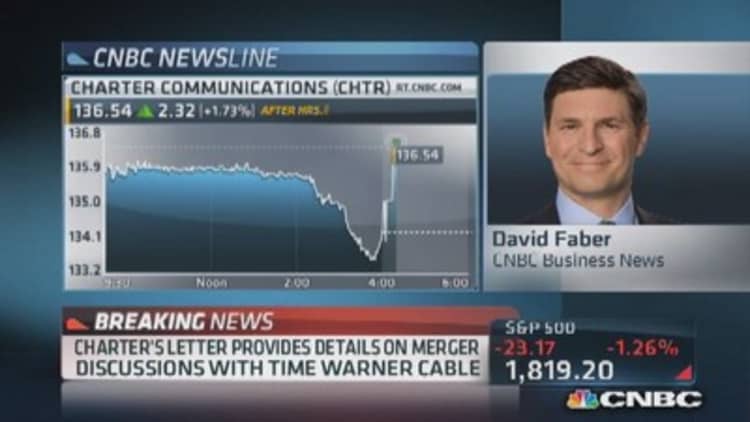

First, news broke that Charter Communications had sent a new letter to Time Warner Cable discussing the possibility of a merger.

Both stocks saw a 1 percent in pop in after-hours trading.

Brian Kelly said that the offer, valued somewhere in the $130-per-share range, sets up a great trade in Time Warner, adding, that "$130 is now your floor, so it's an asymmetric trade. … Somebody's going to come in here and bump this up. I'd buy Time Warner here."

Google also made headlines Monday after announcing its acquisition of Nest Labs, a home-hardware maker, for $3.2 billion in cash.

CNBC's Jon Fortt gave the breakdown of what the acquisition could mean for the search giant.

"This is potentially huge on a number of levels," he said. "This is potentially a YouTube moment for the post-smartphone era."

Google acquired YouTube for around $1.65 billion back in October of 2006.

Josh Brown of Ritholtz Wealth Management said that the "Internet of everything," an umbrella term for interconnected appliances and technologies including those made by Nest Labs, could be "the next industrial revolution."

(Read more: Bet on big banks: Bill Nygren)

Tim Seymour said that Google is the best way to play the "Internet of things," saying, "I think it's a genius purchase. I think it's a fantastic company. I think Google has a lot more of these up their stream."

But Seymour did warn about the potential security concerns related to interconnectivity.

"You think it's creepy how people can see your key strokes? Nest understands tastes about how you live your life," he said.

4.The Smart Home Revolution

On Tuesday, "Fast Money" dug deeper into the "Internet of things" with a company aiming to turn household items into internet-connected devices.

Alex Hawkinson, the founder and CEO of SmartThings, an open-platform software and hardware company, joined the crew Tuesday to talk about the emerging industry.

Hawkinson said that the impact of his company's technologies, which are compatible with products from Honeywell, GE and others, is "profound" for consumers, providing security and peace of mind.

Hawkinson also weighed in on Google's acquisition of Nest, a company that also makes Internet-connected devices.

(Watch video: The smart house revolution)

"I think it's great for the entire industry," he said. "We've really seen this as the tipping point year, 2014, where a lot of these technologies really gain mass-market adoption."

Brian Kelly of Brian Kelly Capital gave a tradable way to play the new home revolution.

"I think you go Badger Meter, BMI. They make all the smart meters that go into the utilities," he said.

Karen Finerman of Metropolitan Capital also said that Google is the best way to play the "Internet of things," especially given its acquisition of Nest.

"It doesn't move the needle, this acquisition, but the tentacles are getting into your car, your smartphone, your home," she said. "That's interesting."

5. Tesla drives higher

The markets rebounded Tuesday, with big winners from 2013 like Facebook and SolarCity taking the lead.

One company driving the gains was Tesla.

The electric-car maker jumped 16 percent in Tuesday's session after reporting fourth-quarter deliveries that were 20 percent above estimates.

(Read more: Tesla's projections are through the roof: Pro)

On "Closing Bell," Tesla CEO Elon Musk said that he's "very optimistic" about his company's prospects this year.

"Our rough aspirations … are to be somewhere in excess of 800 vehicles a week by the end of the year," he said.

R.W. Baird Analyst Ben Kallo upgraded the stock to outperform on Tuesday, and joined "Fast Money" to explain his move.

"The news today was definitely positive. I think we'll continue to see gross margins improve throughout the year," he said.

Kallo also said that overall sentiment on the name has shifted to a "negative place," and that Tesla should easily be able to beat the street's low expectations.

Brian Kelly said he would still look to buy Tesla, despite the day's big run.

6. The Moral Downgrade, Part II

A controversial call last week drove "Fast Money" viewers to Twitter to discuss the "moral downgrade" of Apple. On Wednesday, the analyst who blacklisted Apple for ethical reasons stopped by the NASDAQ to reiterate his case.

Ronnie Moas of Standpoint Research said that overseas workers, who make components for Apple products, need to be paid more.

"In this country, if they would treat their workers the way the people in Asia are being treated, the management would be thrown in jail," he said. "What Apple is doing on the backs of these people that built the company to what it is, is just mind boggling to me."

(Watch video: )

When pressed whether the root cause of low pay is in fact China's minimum wage standards, Moas said, "It's very convenient for Apple to hide behind that defense."

Tim Seymour countered that it's challenging to say the problem of global inequality is specifically tied to Apple, and the point was raised that Moas's argument appeared to be more of a political case than a research note.

"I can argue whatever I want to argue," Moas said. "I'm not a socialist, but I think it's obscene the amount of money that is controlled by the top 1 to 2 percent of the country."

7. The App Everyone's Whispering About

With more than 3 billion page views per month, anonymous secret-sharing app "Whisper" is gaining momentum as the next big thing in social media. Whisper CEO Michael Heyward joined the crew Wednesday to talk about his app.

"I think anonymity is going to be a really, really big deal, and probably a lot bigger than most people think right now," he said. "Whisper is really well positioned to own anonymity."

Whisper allows users to post their deepest secrets anonymously, turning posts into internet memes that can be shared on the platform.

(Watch video: )

Apart from a high number of monthly page views, the app has another thing going for it: its demographic. Women make up 70 percent of Whisper's users, and the primary age range is 18 to 24.

"Clearly it's a really coveted demo," Heyward said.

As far as monetizing the site, Heyward said advertiser interest is growing.

"Not a week goes by that we don't get hit up by advertisers," he said.

8. A bloody day for Best Buy

Shares of Best Buy plunged nearly 30 percent Thursday after the company reported disappointing holiday same-store sales.

Tim Seymour said he wasn't surprised by the big drop.

(Watch video: Is Best Buy broken?)

"When a stock triples in 2013, it sets itself up for this kind of a move," he said. But, he added, "I don't think this company is going out of business… I think this was an overreaction."

Brian Kelly agreed that the massive selloff was overdone.

"I think this is a huge opportunity to buy this stock, at least for a trade," he said.

TradeMonster's Guy Adami also saw an opportunity to buy the dip.

"For all the technical reasons…for a trade, at 27 bucks it's pretty interesting."

Karen Finerman said the stock is now fairly priced, and that she wouldn't be buyer.

Janney analyst David Strasser called Best Buy one of his top picks for 2014 in December. After the dramatic selloff, Strasser stopped by to provide an update.

"I think they're going to be fine," he said.

Strasser pointed out that it's a challenging environment for all retailers, which could actually help Best Buy in the long run.

"Sears got hurt really bad this holiday. Toys 'R' Us, which does a lot in the electronics now, got hurt bad this holiday," he added. "The ones that survive are going to have a lot more market share out there."

—By CNBC's Michael Newberg. Follow him on Twitter: .