The rough month for stocks—being capped Friday by another sharp decline on Wall Street—is raising concerns about whether the recent selloff is the start of the long-feared correction and whether 2014 is doomed because of the often-accurate January barometer.

Two leading market-watchers told CNBC that the recent downturn won't turn into a true correction, but another analyst predicted a steeper 15 percent decline.

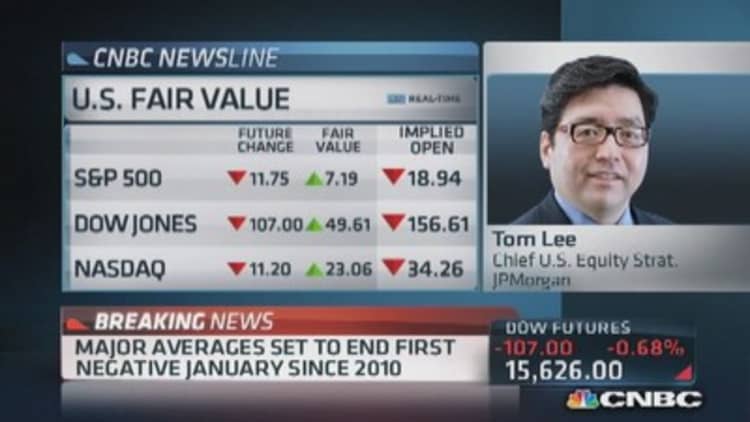

On the optimistic side, JPMorgan chief U.S. equity strategist Tom Lee said in a "Squawk Box" interview that he didn't think a 10 percent correction was likely. "The reason I think we're not going to go down as much as 10 is the high yield market is behaving. And high yield market has led equities."

"I think we're within a couple percent of the bottom," Lee added—predicting that stocks could "decline like [during one of the selloffs] last year, which by the time we were down 6 percent or 7 percent it feels horrible."

But he concluded that 2014 is going to turn into a solid year. "I think we're going to end at least at 2,075."

James Paulsen, chief investment strategist at Wells Capital Management, also told CNBC that the current market drop is not the start of a 10 correction. "When I look at the character of the market, this isn't it. I think we're maybe going to rally higher this year before we get a 10 percent correction."

(Read more: Stocks down 4% in January! If history repeats ...)

Like Lee, Paulsen said, "We may be bottoming here over the next few weeks. I just don't think the market is facing as many hurdles as we seem to think."

"The big elephant in the room at the end of the day is going to be momentum over the United States economy," he added. "And it's pretty good"—an assertion backed-up by the release Thursday of the government's GDP report, which showed the economy grew by 3.2 percent in the fourth quarter of 2013, in line with expectations.

"If we continue to print good numbers in the United States, the market is going to forget about emerging markets." Paulsen said. "If the market stays down and shows some signs of bottoming, a lot of new buyers [could be] coming into the market."

He said he expects the S&P to rise toward 2,000 sometime this year, before correcting back toward the 1,850 level by year-end.

After last year's 30 percent gain, stocks have had a rough start in 2014. The Dow Jones Industrial Average has dropped more than 4 percent as of Thursday's close, while the has fallen about 3 percent.

(Read more: As goes January ... so expect a volatile year)

If the old adage "as goes January, so goes the year" holds true, investors could be in for a volatile year. The January barometer has been right in 62 of the last 85 years, or 73 percent of the time.

Let's turn to the bad news now.

Crunching historical numbers on stocks, one strategist who spoke to CNBC on Friday warned the market could see a painful 15 percent correction.

Rick Bensignor at Wells Fargo Securities told "Squawk Box" that his research shows parallels between the market highs in December and the peak in September 1929.

Notice the similarities between the two charts.

He stressed that he's "not looking for a crash ... like what ultimately took us to the 1932 bottom," but pointed out the first leg of the decline then was 15 percent.

Given market forces today, a similar 15 percent decline could happen in the near-term, he added.

—By CNBC's Matthew J. Belvedere. Follow him on Twitter @Matt_SquawkCNBC.