America is becoming a country of two consumers.

For the most part, U.S. households are in a spending mood again, helping to drive a faster recovery from the Great Recession. Strong gains in personal spending got much of the credit for the solid 3.2 percent rise in gross domestic product reported by the government Thursday.

But not all households are joining the shopping spree, as retailers serving the lower end of the income ladder report intense profit pressure as they slash prices to maintain foot traffic.

The latest evidence came from Wal-Mart. The world's largest retailer extended a series of profit warnings to investors Friday, saying that earnings may be lower than expected—perhaps much lower.

(Read more: Wal-Mart adds to gloom, guides 4Q earnings lower)

The announcement followed similar profit disappointments from deep discounters after they slashed holiday prices to avoid getting stuck with unsold goods. Despite aggressive promotion, Family Dollar's same-store sales fell 3 percent last month.

There are other reasons for Wal-Mart's profit stumbles, including intense competition from other store chains catering to price-conscious shoppers. But all retailers selling to the highly budget-focused face the same pressures.

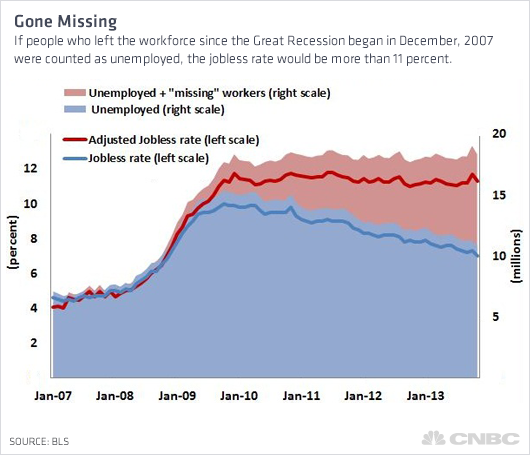

While consumer spending overall rose more than expected in December, income growth remained flat and, after adjusting for inflation, fell two-tenths of a percent. That pattern of stalled wage growth—unchanged since the Great Recession ended—is hitting people at the lower end hardest.