China continued to mint more billionaires over the past year, driven largely by technology, with a two-horse race developing in the country's internet sector, according to the latest Hurun rich list.

The mainland minted 41 fresh U.S. dollar billionaires over the past year, for a total of 358 who have amassed a total of $963 billion, the report said.

It's second only to the U.S., which spawned 72 new billionaires, pushing its total to 481, based on a "snapshot" of data on January 17.

(Read more: Rich Chinese continue to flee China)

Globally, the Nine-Zero Club's total membership rose by 414 to 1,867 with a cumulative piggybank of $6.9 trillion, larger than the gross domestic (GDP) product of the world's third largest economy, Japan, Hurun said, although it noted its data may undercount the sometimes elusive club members.

The jingle in the piggybanks is getting a big boost from technology players, overtaking real estate as the key driver of wealth creation globally, and China was no exception, the report found.

The Year of the Horse has spurred a "two-horse race" between Chinese technology billionaires.

(Read more: China has a word for its crass new rich)

Jack Ma of Alibaba saw his wealth triple over the past year to $7.1 billion, ranking him at 192 on the global list, while Pony Ma of Tencent doubled his pocket change to $14 billion, ranking 70 on the global list, Hurun said, noting the Chinese family name "Ma" means horse.

Jack Ma owns 7 percent of Alibaba, which dominates China's ecommerce market and the company could be could be valued at more than $100 billion after its IPO later this year, Hurun noted.

(Read more: Chinese wealthy pull back on luxury spending)

But while technology is gaining ground, real estate remained a key driver of China's billionaire engine. Wang Jianlin, chairman of Dalian Wanda, ranks 26 on the global billionaire list with a $25 billion fortune, making him the highest ranked mainlander, Hurun said.

Wang has been busy over the past year. "He has now become the largest landlord in the country with 18 million square meters, and internationally. Wang has succeeded in listing his U.S. cinema chain, has purchased Sunseeker, a U.K. luxury yacht brand, has announced a $1 billion development in London and has purchased a Picasso painting for $28 million," Hurun said.

In addition, energy tycoon Li Hejun shot up to rank 136 with a $9.1 billion piggy bank on the back of his hydropower and solar businesses, the report said.

Many of China's billionaires are politically connected, with 90 holding senior political positions, up from 83 last year, the report said, with that set including NPC delegate Zong Qinghou of Wahaha, ranked 35 globally with a $20 billion bank account and Chinese People's Political Consultative Conference (CPPCC) delegate Robin Li of Baidu with a $10 billion fortune.

(Read more: Billionaire Population Hits 1,453—Or Maybe 4,000)

To be sure, China may be gaining, but the U.S. still tops the list for the richest billionaires.

"It has been a year when developed markets have reasserted themselves against emerging markets," said Rupert Hoogewerf, chairman and chief researcher at Hurun Report, in a statement.

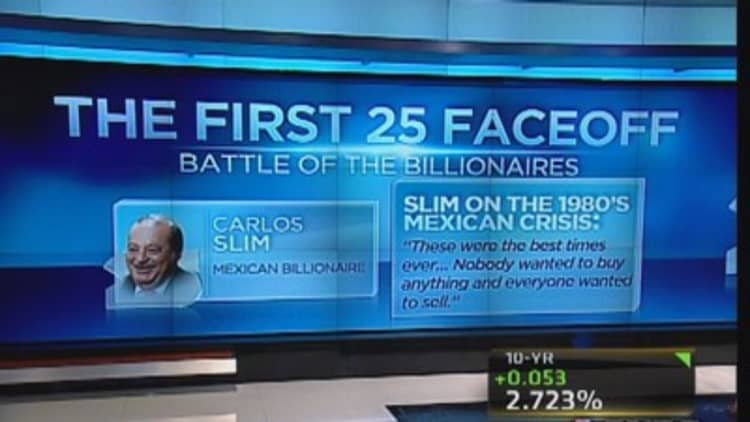

Microsoft founder Bill Gates retook the top spot with a $68 billion piggybank, up $14 billion over the past year, after Mexican tycoon Carlos Slim Helu took a hit from recent travails in emerging markets, the report found.

(Read more: Helping the rich to become $100 trillion industry)

Slim slipped to number four, with his total falling by $6 billion to around $60 billion as the Mexican peso weakened and the value of America Movil slipped, Hurun said. One hopes he doesn't need to economize too much.

Warren Buffett and Zara founder Amancio Ortega kept their second and third ranking for a second year, with their bank accounts swelling 10 percent and 13 percent to $64 billion and $62 billion respectively, the report found.

—By CNBC.Com's Leslie Shaffer; Follow her on Twitter @LeslieShaffer1