Fast-rising home prices in 2013 gave U.S. borrowers back much-needed equity in their homes. The housing crash and subsequent plunge in prices during the end of the last decade put millions of borrowers "underwater" on their mortgages—owing more than their homes were worth.

Nearly 4 million of those borrowers came back above water in 2013, according to a new survey from Zillow. But 9.8 million are still drowning in housing debt, or so-called negative equity.

"We've reached an important milestone as negative equity has fallen below 20 percent nationwide, which has helped free up marginally more inventory and contribute to further stabilization of the market," Zillow's chief economist, Stan Humphries, said in a release.

"But a number of headwinds will prevent negative equity from falling at the kind of sustained, rapid pace we need before the market can completely return to normal, and it remains roughly four times what it is in a healthier market," he added.

High negative equity has kept millions of borrowers stuck in place and prompted others to walk away from their homes and their debt, contributing to the foreclosure crisis.

The housing market is suffering from a severe lack of properties for sale, and much of that is due to negative equity and "effective" negative equity. The latter refers to when a potential seller does not have enough equity to afford a sale and a down payment on another home. That rate now stands at 37.6 percent nationally, according to Zillow.

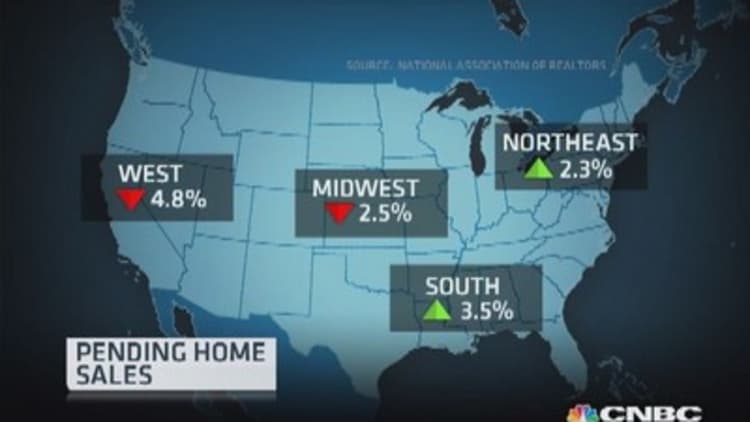

Effective negative equity also stunts both inventory and sales, as potential move-up buyers are stuck. A report Friday on signed purchase contracts for existing homes in January showed volume down 9 percent from a year earlier, according to the National Association of Realtors.

"Limited inventory also is playing a role, especially in the West, while credit remains tight and affordability isn't as favorable as it was a year ago," said Lawrence Yun, the association's chief economist.

(Read more: Housing 'nirvana' around the corner: Star analyst)

Rising prices are clearly a double-edged sword in the recovery. Double-digit gains are giving homeowners more equity as well more confidence in the market, but declining affordability is hurting potential buyers.

And the recovery in prices and equity is increasingly local. Negative equity is still high in markets with elevated foreclosure rates, such as Atlanta (35 percent), Chicago (30 percent) and Las Vegas (35 percent).

Meanwhile, in markets where prices are soaring, including San Francisco, the foreclosure rate has dropped to 11 percent.

Gary Montgomery, who was underwater on his Burbank, Calif., house, is finally ready to put it on the market and move to Colorado to be closer to his grandchildren.

(Read more: CEOs are bucking housing's bad numbers)

"The price situation, I felt a lot better when I saw it the last couple of months," he said. "We've had a couple of homeowners sell their homes that are within a ball throw, and they did very well, and it gave me the feeling that we would at least get on the green side again."

While inventory is extremely tight in Montgomery's neighborhood, there is a growing tension between demand and affordability. His real estate agent sees it every day.

(Read more: Cost of owning a home is spiking in 2014)

"I don't think anybody's afraid to sell right now with rising home prices," said Gigi Santoro of Santoro and Sons Real Estate Group. "I think there's somewhat of a panic on the buyers side to find anything that they can afford now. With rising home prices and rising rates, those two in tandem, cause everybody a lot of problems to qualify, so somebody who might be able to qualify for something six months ago can't qualify for that now—it's above their price point."

Home price gains are expected to moderate nationally this year, and some markets could even see price drops, according to the Zillow report. Negative equity is expected to rise in 26 metro markets nationwide, including in St. Louis, and to remain flat in 227 metros.

—By CNBC's Diana Olick. Follow her on Twitter @Diana_Olick.

Questions?Comments? facebook.com/DianaOlickCNBC