Texas auto dealers, who have spent millions of dollars to prevent Tesla from selling cars directly in the Lone Star state, said on Friday that the government should not change its laws to land a giant battery plant being built by the automaker.

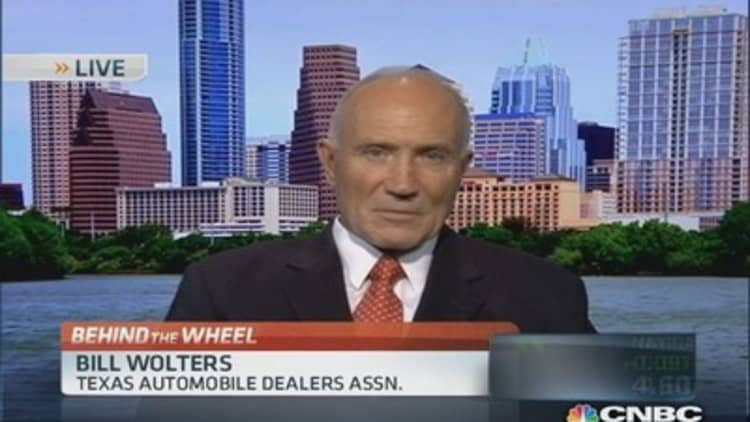

Bill Wolters, president of the Texas Automobile Dealers Association, told CNBC he hopes Texas lands the $4 billion to $5 billion "Gigafactory," but not if it means lifting the state's requirement that all auto sales be done through dealers.

"It is very interesting that a company would come in and say give us your tax abatements, give us our incentives and change the law. You would think they would come to the state based on its own merits," Wolters told CNBC.

"Once you start letting the manufacturers sell direct, then all of a sudden the dealers I have in 163 towns of under 15,000 population, they disappear," he said. "All we would have is dealers in the major metropolitan areas with one price controlled by the factories. That is not good for anyone, certainly not 26 million Texans."

(Read more: Room to run for Tesla? A $30B question)

For the record, Tesla has not said it will locate its new Gigafactory in Texas in exchange for the state changing its franchise laws. However, it would not be surprising if that possibility is discussed, as Tesla considers its options for where to put the facility, which is expected to create 6,500 jobs.

A spokeswoman for Texas Gov. Rick Perry, a Republican, told CNBC the governor's office does not comment about potential ongoing negotiations involving plans to attract companies to Texas.

The initiative is one of those rare opportunities for states and municipalities to land a huge manufacturing facility that could have a major impact on the local and state economy. Along with Texas, Arizona, Nevada and New Mexico are under consideration.

(Read more: Tesla to Texas—How do you like us now?)

"This is the biggest industrial project out there right now," said Dennis Cuneo, who owns the DC Strategic Advisors consulting firm in Washington, D.C. "These types of plants do not come along very often and you can bet business and political leaders will do whatever they can to win this facility."

Cuneo speaks from experience. Before leaving Toyota in 2006, he helped the automaker select the sites for several of its U.S. plants, including a truck final assembly plant in San Antonio.

"If I was in one of these states that Tesla is considering, I would stretch as far as possible to make sure this plant comes to my state," he said.

Cuneo said the economic impact of the Gigafactory could go well beyond the 6,500 jobs Tesla is forecasting. There are infrastructure and logistical operations, suppliers and the potential to create a hub for research and development of power and energy systems that would go to the selected state.

Since Tesla announced the Gigafactory, Cuneo said he has been contacted by three states that are not finalists asking how they can get on Tesla's radar. "I wouldn't be surprised if another 20 or 30 states reach out to Tesla at some point to see if they can get this plant," he said.

(Read more: Tesla sets huge note offering, factory plan)

The automaker said it plans to name a site for the Gigafactory soon, with a projected opening of the plant in 2017.

For CEO Elon Musk, the project is all part of his grand vision for lowering the cost of lithium-ion battery packs by as much as 30 percent, while rapidly increasing the supply, so Tesla can keep up with demand for its vehicles.

A primary focus for Tesla is bringing down the cost of the battery pack enough to allow the company to make a profit selling its third-generation car for roughly $35,000 when it debuts in 2017. If successful, Tesla believes that car, which many call the Model E, would lead the automaker's push into selling more affordable electric cars to the mass market.

When that day comes in three years, Wolters believes Texas will still have laws in place banning the direct sales of cars and trucks.

"We are the widest, most prevalent major retailer in our state because we have franchise laws that keep dealers from being terminated by the manufacturer and provide the next generation of dealer families to take over the dealership," he said.

"We have more dealerships in Texas over 75 years old than there are manufacturers over 75 years old. So dealers are eternal in our state and they are not threatening to leave the state," he said. "Dealers provide a much greater economic impact for Texas than Tesla would ever provide."

—By CNBC's Phil LeBeau. Follow him on Twitter @LeBeauCarNews.

Questions? Comments? BehindTheWheel@cnbc.com.