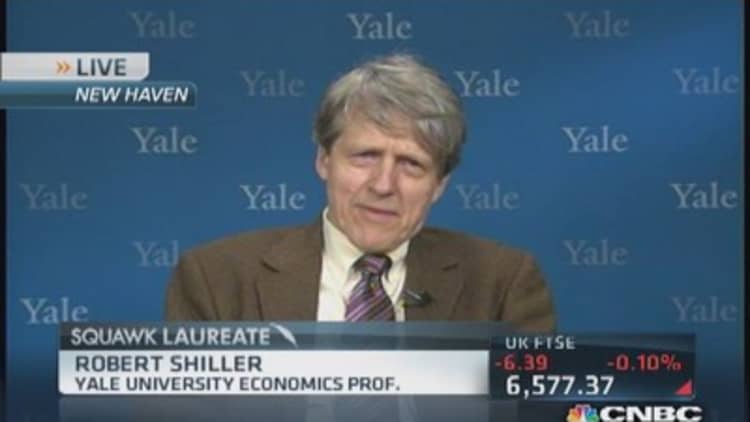

With recent signs that housing may be slowing down a bit, Nobel Prize-winning economist Robert Shiller told CNBC on Tuesday that he'd still describe the recovery as strong.

"There is a certain, substantial amount of momentum in the housing market—much more so than the stock market," the Yale University professor said in a "Squawk Box" interview.

Read MoreGood news from housing market: Foreclosures plunge

"I think this boom we saw in the last year and a half in home prices has something to do with quantitative easing and the record low mortgage rates," Shiller said.

But with signs of possibly higher rates and the Federal Reserve tapering its bond purchases—so far in three, $10 billion chunks—to $55 billion a month, mortgages won't be historically cheap forever, he added.

"The way prices have been increasing since the spring of 2012, it [looked] like a no-brainer to get into the market for a while," he continued. "[But] now there are signs of softening" in building permits and housing starts.

Shiller cautioned that he didn't want to be an alarmist—saying home prices are "kind of at a normal level" right now. He added: "My son just bought a house. I told him, 'Fine.'"

As for housing prices in years to come, "the futures market at the CME is predicting something like 25 percent higher home prices in 2018," the co-founder of the Case-Shiller Home Price Index said.

"That seems like a possibility," he added.

—By CNBC's Matthew J. Belvedere.